Car sales: Slowest lane since 2012

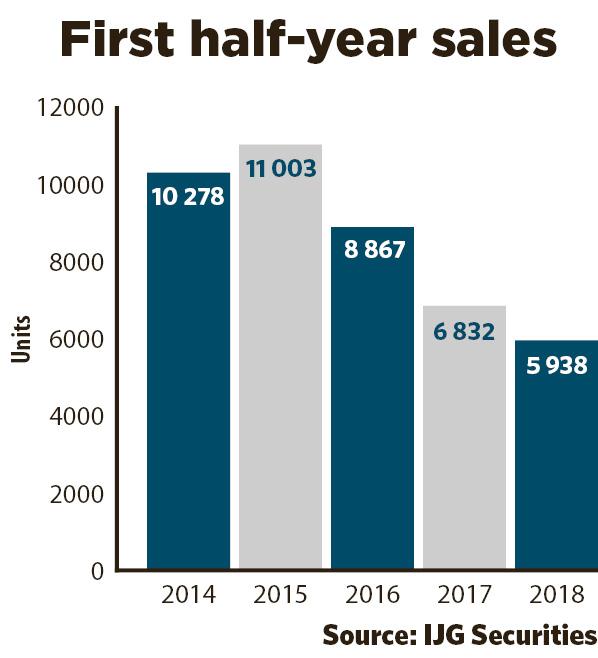

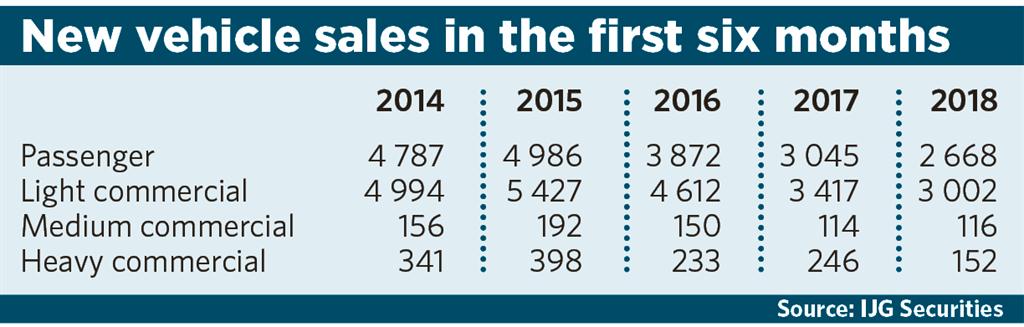

Jo-Maré Duddy – The 5 938 new vehicles that were sold in the first six months of the year are 12% lower than the same time in 2017, making 2018 the slowest year for new car sales since 2012.

IJG Securities says the decline “suggests that vehicle owners are holding on to the vehicles they already own or purchasing second hand and imported vehicles”.

In the year ended June, 12 371 new vehicles were sold, 14% or 2 036 units less than the corresponding period in 2017.

“The continued slowdown in commercial vehicles sales remains worrisome as it is an indication of lower capital expenditure by corporates and lower business confidence in general,” IJG says.

A total of 1 134 new vehicles were sold last month, up 23.5% or 216 from May.

“We believe that the hype around vehicles sales in June was driven by the tourism peak season that started from May and ends in October. This was a seasonal increase and we do not expect excessive increase in new vehicle sales in the coming month,” Simonis Storm (SS) says in its comment on the latest stats.

Compared to June 2017, last month’s sales were 5.4% lower.

Categories

June’s sales by category are: Passenger 465 (up 24% from May), light commercial 607 (up 20%), medium commercial 26 (up 44%) and heavy commercial 36 (up 90%).

Namibia Equity Brokers (NEB) says the Hino 300 Series has been the key driver of the medium commercial category for two months in a row. This small truck is predominantly used for secondary distribution, i.e. from the depots to customers, NEB says.

“Word is that this month’s purchases were for secondary distribution in the grain industry and that this trend is highly likely to continue in the next few months. A purchase of 12 units in one month is a very encouraging signal of some positive outlook for the manufacturing and retail sector,” NEB says.

In the extra heavy category, the Scania R-Series sold 16 units out of the 28 units, NEB says.

“Word is that the purchases are for primary distribution as the purchaser is carrying out a fleet renewal. One is encouraged by these green shoots as they have the potential to offset negative numbers from the other sectors and thus augur well for economic growth,” the analysts say.

IJG Securities says the decline “suggests that vehicle owners are holding on to the vehicles they already own or purchasing second hand and imported vehicles”.

In the year ended June, 12 371 new vehicles were sold, 14% or 2 036 units less than the corresponding period in 2017.

“The continued slowdown in commercial vehicles sales remains worrisome as it is an indication of lower capital expenditure by corporates and lower business confidence in general,” IJG says.

A total of 1 134 new vehicles were sold last month, up 23.5% or 216 from May.

“We believe that the hype around vehicles sales in June was driven by the tourism peak season that started from May and ends in October. This was a seasonal increase and we do not expect excessive increase in new vehicle sales in the coming month,” Simonis Storm (SS) says in its comment on the latest stats.

Compared to June 2017, last month’s sales were 5.4% lower.

Categories

June’s sales by category are: Passenger 465 (up 24% from May), light commercial 607 (up 20%), medium commercial 26 (up 44%) and heavy commercial 36 (up 90%).

Namibia Equity Brokers (NEB) says the Hino 300 Series has been the key driver of the medium commercial category for two months in a row. This small truck is predominantly used for secondary distribution, i.e. from the depots to customers, NEB says.

“Word is that this month’s purchases were for secondary distribution in the grain industry and that this trend is highly likely to continue in the next few months. A purchase of 12 units in one month is a very encouraging signal of some positive outlook for the manufacturing and retail sector,” NEB says.

In the extra heavy category, the Scania R-Series sold 16 units out of the 28 units, NEB says.

“Word is that the purchases are for primary distribution as the purchaser is carrying out a fleet renewal. One is encouraged by these green shoots as they have the potential to offset negative numbers from the other sectors and thus augur well for economic growth,” the analysts say.

Kommentaar

Republikein

Geen kommentaar is op hierdie artikel gelaat nie