Namibia resistant to Eskom power woes

Possible load shedding in South Africa will not affect Namibia, NamPower has said.

NDAMA NAKASHOLE

NamPower has assured Namibians that load-shedding in South Africa will not affect Namibia.

NamPower issued a statement two days after South Africa’s cash-strapped power utility Eskom had warned of possible load shedding as the country struggles with insufficient coal supplies at its power plants.

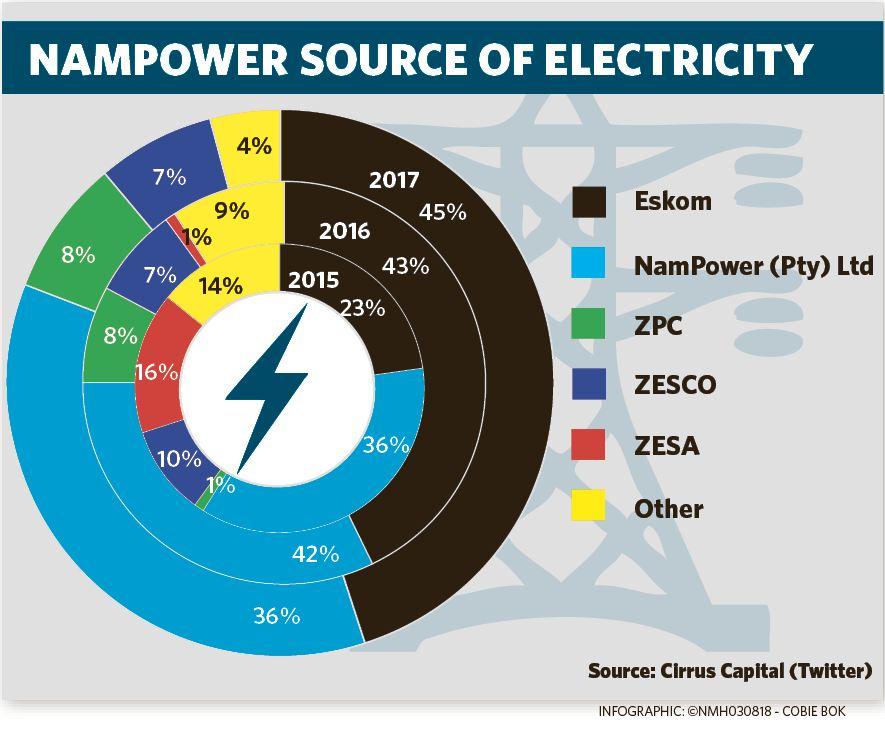

In 2017, 45% of Namibia’s electricity was imported from Eskom. NamPower’s own plants supplied 36% of the country’s energy needs.

NamPower’s manager for corporate communication and marketing, Tangeni Kambangula, told Market Watch yesterday that since Namibia does not solely depend on Eskom for energy, their well-publicised woes have no effect on the Namibian power supply.

Kambangula said Namibia is an active trader in the Southern African Power Pool (SAPP). Apart from the power purchase agreement (PPA) it has with Eskom, Namibia also has PPAs with Zimbabwe Power Corporation (ZPC) and Zambia Electricity Supply Corporation (ZESCO).

ZPC and ZESCO contributed 8% and 7% of Namibia’s energy needs in 2016 and 2017.

Over the past three years, Eskom’s contribution towards Namibia’s power supply has increased: from 23% in 2015 to 43% in 2016 and 45% in 2017.

Despite this increased reliance on Eskom power, Kambangula said some of Namibia’s independent power producers (IPPs) have started contributing to the nation’s power needs.

“Namibia enjoys an increase in locally generated energy, attributed to the national REFIT projects and other IPP projects that have reached completion and are actively feeding into the national grid,” she said.

Root warning

On Monday, Eskom said the risk of nation-wide electricity outages had increased significantly due to a sharp fall in coal stockpiles at five of its power stations.

“The risk of load shedding is there and it’s rising,” said Eskom spokesman Khulu Phasiwe.

“In total, we have 11 coal-fired power stations that have less than the required minimum amount of 20 days’ stockpile. Out of the 11, five of them have less than 10 days of coal stock and that is the challenge.”

Coal crisis

Eskom is running low on coal; municipal debt has ballooned by another R2 billion since May and the risk of load shedding is "very high".

Eskom currently has a total coal stockpile of 25 days. However, some stations are affected worse than others.

The 10 worst-affected stations are Arnot, Camden, Duvha, Hendrina, Komati, Kriel, Kendal, Majuba, Matla and Tutuka, all in Mpumalanga Province. These stations all have less than 20 days of coal, with five of them having less than 10 days of coal, Eskom spokesperson Khulu Phasiwe told Fin24 yesterday.

The situation had measurably deteriorated since earlier in the year, he added, when stockpiles stood at 28 days' worth of coal.

"Clearly there has been a reduction. It is a matter of major concern," he was quoted as saying.

Eskom was doing "everything possible to mitigate it", Phasiwe said, but "the risk of load shedding is very high".

Eskom is in contact with the National Energy Regulator of South Africa (Nersa) regarding the next steps. In the meantime, Eskom's action plan rests on three main prongs:

- Bringing in extra coal as a relief measure. Some is being transported by truck, and there is also an agreement in place with Transnet to bring in extra coal reserves by rail.

-Signing new contracts. While 14 new suppliers are on the horizon, some will only kick in next year. Phasiwe says six suppliers have been willing to start with immediate effect, with four starting this month or early next month.

-Relying on diesel as an interim measure to supply power.

Asked what the impact of relying on diesel is, Eskom said it did not know yet. According to Phasiwe, Eskom will have a "fuller picture" by Friday, which includes some of the cost calculations.

In May, however, Mail & Guardian reported that Eskom's expenditure on diesel for open-cycle gas turbines had increased 30-fold in the first five months of the year alone. Following several fuel price increases throughout the year, SA faced yet another hike in the diesel price early in November.

The cost of relying on diesel is worth preventing load shedding if possible, Phasiwe told Fin24. The cost of load shedding is far higher, he said.

"It is a small price to pay for what South Africa would lose if there were load shedding. So we will continue to run the diesel generators for as long as possible."

Eskom suffered a net loss of R2.3 billion in 2018.

NamPower has assured Namibians that load-shedding in South Africa will not affect Namibia.

NamPower issued a statement two days after South Africa’s cash-strapped power utility Eskom had warned of possible load shedding as the country struggles with insufficient coal supplies at its power plants.

In 2017, 45% of Namibia’s electricity was imported from Eskom. NamPower’s own plants supplied 36% of the country’s energy needs.

NamPower’s manager for corporate communication and marketing, Tangeni Kambangula, told Market Watch yesterday that since Namibia does not solely depend on Eskom for energy, their well-publicised woes have no effect on the Namibian power supply.

Kambangula said Namibia is an active trader in the Southern African Power Pool (SAPP). Apart from the power purchase agreement (PPA) it has with Eskom, Namibia also has PPAs with Zimbabwe Power Corporation (ZPC) and Zambia Electricity Supply Corporation (ZESCO).

ZPC and ZESCO contributed 8% and 7% of Namibia’s energy needs in 2016 and 2017.

Over the past three years, Eskom’s contribution towards Namibia’s power supply has increased: from 23% in 2015 to 43% in 2016 and 45% in 2017.

Despite this increased reliance on Eskom power, Kambangula said some of Namibia’s independent power producers (IPPs) have started contributing to the nation’s power needs.

“Namibia enjoys an increase in locally generated energy, attributed to the national REFIT projects and other IPP projects that have reached completion and are actively feeding into the national grid,” she said.

Root warning

On Monday, Eskom said the risk of nation-wide electricity outages had increased significantly due to a sharp fall in coal stockpiles at five of its power stations.

“The risk of load shedding is there and it’s rising,” said Eskom spokesman Khulu Phasiwe.

“In total, we have 11 coal-fired power stations that have less than the required minimum amount of 20 days’ stockpile. Out of the 11, five of them have less than 10 days of coal stock and that is the challenge.”

Coal crisis

Eskom is running low on coal; municipal debt has ballooned by another R2 billion since May and the risk of load shedding is "very high".

Eskom currently has a total coal stockpile of 25 days. However, some stations are affected worse than others.

The 10 worst-affected stations are Arnot, Camden, Duvha, Hendrina, Komati, Kriel, Kendal, Majuba, Matla and Tutuka, all in Mpumalanga Province. These stations all have less than 20 days of coal, with five of them having less than 10 days of coal, Eskom spokesperson Khulu Phasiwe told Fin24 yesterday.

The situation had measurably deteriorated since earlier in the year, he added, when stockpiles stood at 28 days' worth of coal.

"Clearly there has been a reduction. It is a matter of major concern," he was quoted as saying.

Eskom was doing "everything possible to mitigate it", Phasiwe said, but "the risk of load shedding is very high".

Eskom is in contact with the National Energy Regulator of South Africa (Nersa) regarding the next steps. In the meantime, Eskom's action plan rests on three main prongs:

- Bringing in extra coal as a relief measure. Some is being transported by truck, and there is also an agreement in place with Transnet to bring in extra coal reserves by rail.

-Signing new contracts. While 14 new suppliers are on the horizon, some will only kick in next year. Phasiwe says six suppliers have been willing to start with immediate effect, with four starting this month or early next month.

-Relying on diesel as an interim measure to supply power.

Asked what the impact of relying on diesel is, Eskom said it did not know yet. According to Phasiwe, Eskom will have a "fuller picture" by Friday, which includes some of the cost calculations.

In May, however, Mail & Guardian reported that Eskom's expenditure on diesel for open-cycle gas turbines had increased 30-fold in the first five months of the year alone. Following several fuel price increases throughout the year, SA faced yet another hike in the diesel price early in November.

The cost of relying on diesel is worth preventing load shedding if possible, Phasiwe told Fin24. The cost of load shedding is far higher, he said.

"It is a small price to pay for what South Africa would lose if there were load shedding. So we will continue to run the diesel generators for as long as possible."

Eskom suffered a net loss of R2.3 billion in 2018.

Kommentaar

Republikein

Geen kommentaar is op hierdie artikel gelaat nie