Chasing tourism’s many galaxies

‘Rebuild trust, commitment and confidence’

Namibia has the potential to regain its place in the world's tourism market post-Covid, but it needs skills and money.

Tourism is slowly recovering after two years of lockdowns, restrictions and uncertainty, says the chief executive officer of the Hospitality Association of Namibia (HAN), Gitta Paetzold, and her words are reflected in official figures.

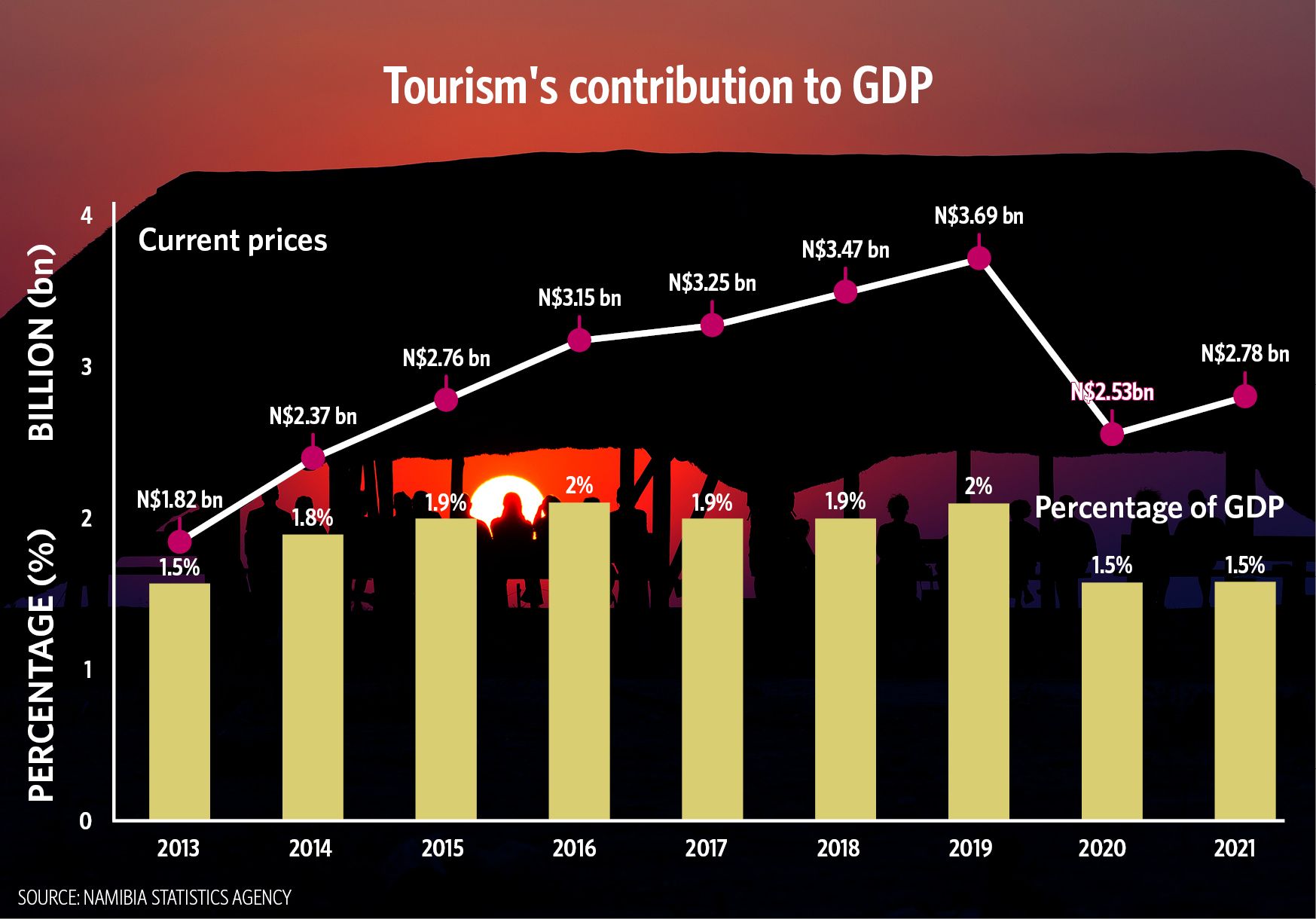

According to preliminary data of the Namibia Statistics Agency (NSA), hotels and restaurants – a proxy for tourism – last year contributed about N$2.3 billion to the country’s gross domestic product (GDP) in real terms. Although some N$219 million more than the previous year, hotels and restaurants’ GDP share was still far below the more than N$3 billion it pumped into the economy in 2019.

Prior to the past two years, the sector’s stake in the economy in real terms was last at the N$2.3-billion level in 2013. Real terms take inflation into account and the figures are based on the constant prices of 2015.

Reflecting on the past two years, Paetzold says a number of jobs were lost: people were either put on long-term sabbaticals, retrenched or encouraged to find alternative sources of income or further their studies.

“Although the hospitality and restaurant sector in Namibia has been lucky in some way to have been able to remain operational since May 2020 (despite global travel bans and lockdowns), the capacity restrictions, bans on the sale of alcohol, regional lockdowns and border closures have caused a severe reduction on output and capacity of operations,” she says, adding: “Many tourism players were forced to reduce their workforce to an absolute limit. Even when borders re-opened and the travel trend grew, employers seemed hesitant to re-instate the full staff component, due to financial constraints.”

UPTICK IN NUMBERS

An analysis by Simonis Storm (SS), based on the latest HAN figures, shows that foreign arrivals at the Hosea Kutako International Airport in February were up 134.5% compared to February 2021, while regional arrivals increased by 179.1%.

“While there has been a recovery in foreign arrivals since the lockdown period in 2020, the latest monthly foreign arrivals in February 2022 is about 30% of the monthly average in 2019 and 26% of 2018’s monthly average. That indicates that much room for growth remains in the tourism sector,” SS said.

A national occupancy rate of 22.5% was recorded in February 2022, up from 18.5% the previous month.

The majority of foreign tourists who visited local establishments in February travelled from Germany, Austria and Switzerland combined (24.4%), South Africa (7.4%), France (1.9%), Benelux (1.8%), the UK and Ireland (1.2%), Asia (1.3%), the US and Canada (0.7%), other SADC (0.2%) and Middle East (0.1%) among other.

Hotels with more than 30 rooms posted the highest occupancy rate of 40.4% in February 2022, followed by pensions (32.5%), B&Bs (27.5%), guest farms (23%) and tented camps (18.6%), according to SS.

PROSPECTS

SS said the tourism sector is one of few sectors that support its GDP growth forecast of 2.5% in 2022.

“We remain positive on seeing a rebound in foreign arrivals and national occupancy rates,” the analysts said, adding: “Marketing Namibia as a country with greater ease of access of vaccinated travellers, sparse population density and life being close to normal or pre-pandemic will go a long way in attracting additional travellers.”

However, SS pointed out this might be a challenging task for the tourism sector regulator as the ministry of environment, tourism and forestry continue to see a lower budget allocation. Out of a total budget of nearly N$70.8 billion for 2022/23, only about N$478.95 million was allocated to this ministry.

“Marketing services and activities will therefore have to be done by private sector industry players,” SS said.

Paetzold agrees with SS about the sector’s potential: “Tourism is one of the economic sectors for which recovery and growth is guaranteed. Especially after the lockdowns and travel restrictions, people across the globe are keen to break away and to take up opportunities for face-to-face human interaction, adventure and travel.”

MONEY

According to Paetzold, the biggest challenge tourism currently faces seems to be financial.

“Most tourism entities have exploited all savings, reserves and loans over the past two years. In terms of building back better and re-igniting activities, employment and products, a huge challenge lies in not being able to access necessary finances to be able to do often even the most basic maintenance of restocking,” she adds.

Although international markets hunger for destinations like Namibia which offers diversity, space and safety, the country needs to ensure that it is able to provide the high quality and international standards that people were used to before Covid.

“While some parties may still not feel certain enough to make pre-payments and deposits, fearing a recurrence of shutdowns and closures, the service providers are under pressure to ensure that all preparations and quality assurances are set prior to arrival of guests,” Paetzold says.

However, they lack the financial backing to complete all preparations. “Banks also still seem hesitant to assist service providers, as two years of financial hardship and lack of income have also branded tourism as a risky business,” she says.

SKILLS

“Now that most (not all) uncertainty is lifted and tourism back on the road, many tourism enterprises - be it establishments, operators or consultants – are in dire need of trained staff, especially at managerial level,” Paetzold says. This is not only the case in Namibia, but a global result of the Covid-19 pandemic.

“It would seem that during the two years of restrictions and bans, many enterprise managers were compelled to seek employment outside tourism, and were able to do so given their level of skills and education,” she explains.

There is an urgent need to ensure that the sector has the relevant number of trained/skilled staff to provide the services required. Catering, hospitality and guiding are some of the key positions for which qualified staff is needed, Paetzold says.

“Luckily, training is available on various platforms - be it hotel schools, training institutions and especially the vocational training offered. Recently, online tourism and hospitality training has also re-surfaced, so opportunities are far and wide,” she adds.

Paetzold says hopefully the youth can be enticed to choose tourism as their career path. “This may also open opportunities for international work experience, as a number of resorts and institutions are currently focusing on source-market exchange programmes and opportunities.”

TRUST

“We need to rebuild trust, commitment and confidence,” Paetzold says. Understanding the travel trade and the tourism sector is key to this.

“Unfortunately there are no guarantees that what has happened over the past two years cannot happen again - rebuilding, re-opening, just to be shut down again.

The latest crash through Omicron was a very hard lesson to learn, Paetzold says. After Namibia had spent heavily to re-open and recover, and was doing well, it to face an avalanche of cancellations due to international travel rulings.

“The sharing of risks and the understanding, that the business model of tourism is complex, are key,” Paetzold says.

According to preliminary data of the Namibia Statistics Agency (NSA), hotels and restaurants – a proxy for tourism – last year contributed about N$2.3 billion to the country’s gross domestic product (GDP) in real terms. Although some N$219 million more than the previous year, hotels and restaurants’ GDP share was still far below the more than N$3 billion it pumped into the economy in 2019.

Prior to the past two years, the sector’s stake in the economy in real terms was last at the N$2.3-billion level in 2013. Real terms take inflation into account and the figures are based on the constant prices of 2015.

Reflecting on the past two years, Paetzold says a number of jobs were lost: people were either put on long-term sabbaticals, retrenched or encouraged to find alternative sources of income or further their studies.

“Although the hospitality and restaurant sector in Namibia has been lucky in some way to have been able to remain operational since May 2020 (despite global travel bans and lockdowns), the capacity restrictions, bans on the sale of alcohol, regional lockdowns and border closures have caused a severe reduction on output and capacity of operations,” she says, adding: “Many tourism players were forced to reduce their workforce to an absolute limit. Even when borders re-opened and the travel trend grew, employers seemed hesitant to re-instate the full staff component, due to financial constraints.”

UPTICK IN NUMBERS

An analysis by Simonis Storm (SS), based on the latest HAN figures, shows that foreign arrivals at the Hosea Kutako International Airport in February were up 134.5% compared to February 2021, while regional arrivals increased by 179.1%.

“While there has been a recovery in foreign arrivals since the lockdown period in 2020, the latest monthly foreign arrivals in February 2022 is about 30% of the monthly average in 2019 and 26% of 2018’s monthly average. That indicates that much room for growth remains in the tourism sector,” SS said.

A national occupancy rate of 22.5% was recorded in February 2022, up from 18.5% the previous month.

The majority of foreign tourists who visited local establishments in February travelled from Germany, Austria and Switzerland combined (24.4%), South Africa (7.4%), France (1.9%), Benelux (1.8%), the UK and Ireland (1.2%), Asia (1.3%), the US and Canada (0.7%), other SADC (0.2%) and Middle East (0.1%) among other.

Hotels with more than 30 rooms posted the highest occupancy rate of 40.4% in February 2022, followed by pensions (32.5%), B&Bs (27.5%), guest farms (23%) and tented camps (18.6%), according to SS.

PROSPECTS

SS said the tourism sector is one of few sectors that support its GDP growth forecast of 2.5% in 2022.

“We remain positive on seeing a rebound in foreign arrivals and national occupancy rates,” the analysts said, adding: “Marketing Namibia as a country with greater ease of access of vaccinated travellers, sparse population density and life being close to normal or pre-pandemic will go a long way in attracting additional travellers.”

However, SS pointed out this might be a challenging task for the tourism sector regulator as the ministry of environment, tourism and forestry continue to see a lower budget allocation. Out of a total budget of nearly N$70.8 billion for 2022/23, only about N$478.95 million was allocated to this ministry.

“Marketing services and activities will therefore have to be done by private sector industry players,” SS said.

Paetzold agrees with SS about the sector’s potential: “Tourism is one of the economic sectors for which recovery and growth is guaranteed. Especially after the lockdowns and travel restrictions, people across the globe are keen to break away and to take up opportunities for face-to-face human interaction, adventure and travel.”

MONEY

According to Paetzold, the biggest challenge tourism currently faces seems to be financial.

“Most tourism entities have exploited all savings, reserves and loans over the past two years. In terms of building back better and re-igniting activities, employment and products, a huge challenge lies in not being able to access necessary finances to be able to do often even the most basic maintenance of restocking,” she adds.

Although international markets hunger for destinations like Namibia which offers diversity, space and safety, the country needs to ensure that it is able to provide the high quality and international standards that people were used to before Covid.

“While some parties may still not feel certain enough to make pre-payments and deposits, fearing a recurrence of shutdowns and closures, the service providers are under pressure to ensure that all preparations and quality assurances are set prior to arrival of guests,” Paetzold says.

However, they lack the financial backing to complete all preparations. “Banks also still seem hesitant to assist service providers, as two years of financial hardship and lack of income have also branded tourism as a risky business,” she says.

SKILLS

“Now that most (not all) uncertainty is lifted and tourism back on the road, many tourism enterprises - be it establishments, operators or consultants – are in dire need of trained staff, especially at managerial level,” Paetzold says. This is not only the case in Namibia, but a global result of the Covid-19 pandemic.

“It would seem that during the two years of restrictions and bans, many enterprise managers were compelled to seek employment outside tourism, and were able to do so given their level of skills and education,” she explains.

There is an urgent need to ensure that the sector has the relevant number of trained/skilled staff to provide the services required. Catering, hospitality and guiding are some of the key positions for which qualified staff is needed, Paetzold says.

“Luckily, training is available on various platforms - be it hotel schools, training institutions and especially the vocational training offered. Recently, online tourism and hospitality training has also re-surfaced, so opportunities are far and wide,” she adds.

Paetzold says hopefully the youth can be enticed to choose tourism as their career path. “This may also open opportunities for international work experience, as a number of resorts and institutions are currently focusing on source-market exchange programmes and opportunities.”

TRUST

“We need to rebuild trust, commitment and confidence,” Paetzold says. Understanding the travel trade and the tourism sector is key to this.

“Unfortunately there are no guarantees that what has happened over the past two years cannot happen again - rebuilding, re-opening, just to be shut down again.

The latest crash through Omicron was a very hard lesson to learn, Paetzold says. After Namibia had spent heavily to re-open and recover, and was doing well, it to face an avalanche of cancellations due to international travel rulings.

“The sharing of risks and the understanding, that the business model of tourism is complex, are key,” Paetzold says.

Kommentaar

Republikein

Geen kommentaar is op hierdie artikel gelaat nie