COMPANY NEWS IN BRIEF

City Lodge doubles revenue

While it’s not back to its pre-pandemic position, the City Lodge Hotel Group has doubled its revenue over the past year.

The group's results for the financial year until the end of June 2022, released on Wednesday, show revenue more than doubled from R0.51 billion in the 2021 financial year to R1.10 billion in 2022 - still about a quarter below its pre-pandemic performance in 2019.

The group reported a profit after tax of R81.7 million compared to a net loss of R804.6 million in 2021. Its profit after tax is still 60% below 2019 levels.

It suffered a headline loss per share of 9c over the past year, an improvement on a loss per share of 91c in the previous financial year. As in 2021, the group has again not declared a dividend.

Average group occupancies increased from 19% last year to 38% in the past year. Occupancies for SA hotels averaged 40% compared to 21% in 2021. SA hotels recorded occupancies of 53% in July 2022, 52% in August 2022, and 56% up to 18 September 2022.

"While the Covid-19 pandemic still lingers, the burden on the hospitality, travel and tourism sector lightened significantly during the year under review," CEO Andrew Widegger said in a statement.

"Occupancy rates heading north of 50% excites me, especially if they can reach pre-Covid-19 occupancy levels on the lower cost base," says Muneer Ahmed, equity analyst at Denker Capital. He says it’s clear that the second half was much stronger than the first due to a lifting of lockdown restrictions.-Fin24

Blow to McDonald's in case

A federal judge has allowed a discrimination lawsuit to proceed that argues that McDonald's refuses to advertise on Black-owned media networks.

Media entrepreneur Byron Allen, who is Black, has accused McDonald's of instituting a "racially discriminatory contracting process" in a lawsuit first filed in May 2021.

As the owner of Entertainment Studios Networks and the Weather Group, which includes the Weather Channel, he sought $10 billion in damages alleging that McDonald's established "a two-tiered, race based system and shut plaintiff out of the general market (i.e. white-owned media) tier."

However, a federal judge dismissed the suit in December, saying that the allegations were not sufficiently supported.

Following a legal back-and-forth, the same judge on Friday denied a request by McDonald's to dismiss the case, thereby allowing it to proceed.

Allen alleged that were his company white-owned it "would have received tens of millions of dollars in advertising revenue from McDonald's on an annual basis."

He also alleged that McDonald's contracts with a separate advertising agency for "African-American media" with an aim of spending a budget that "is de minimis compared to the general market budget."

Allen argues his company had programming geared towards a variety of viewers, especially after its 2018 purchase of the Weather Channel, and that McDonald's has advertised on "similarly situated, white-owned networks."-Fin24

Tencent Music rises after Hong Kong debut

Tencent Music Entertainment Group traded higher in Hong Kong’s exchange on Wednesday after a listing that didn’t involve selling new shares or raising funds.

The stock closed at HK$18.22 on Wednesday, having started at HK$18. Two class A shares in Hong Kong are equivalent to one American depository receipt in New York. The ADRs closed at $4.58 (HK$35.95) on Tuesday.

The Shenzhen-based company chose to debut in the Asian financial hub by way of introduction, a quicker and easier route for firms already listed elsewhere.

The firm controlled by tech giant Tencent is part of a growing group of Chinese firms choosing the method to list closer to home as escalating Sino-US tensions fuel delisting risks stateside.

According to terms of the listing, holders of ADRs will have the option to cancel their ADRs and receive equivalent class A shares in Hong Kong.

Volatile equity markets, high inflation and surging interest rates capped valuations worldwide for companies seeking to go public this year through traditional initial public offerings. As a consequence, there’s been a slump in proceeds raised in venues including New York, London and Hong Kong.

Electric-vehicles producer Nio Inc. debuted in Hong Kong in March using the same process, and later began trading in Singapore via the method. US-listed platform for housing transactions and services KE Holdings Inc. and software-as-a-service firm OneConnect Financial Technology Co. took the same path earlier this year.-Fin24

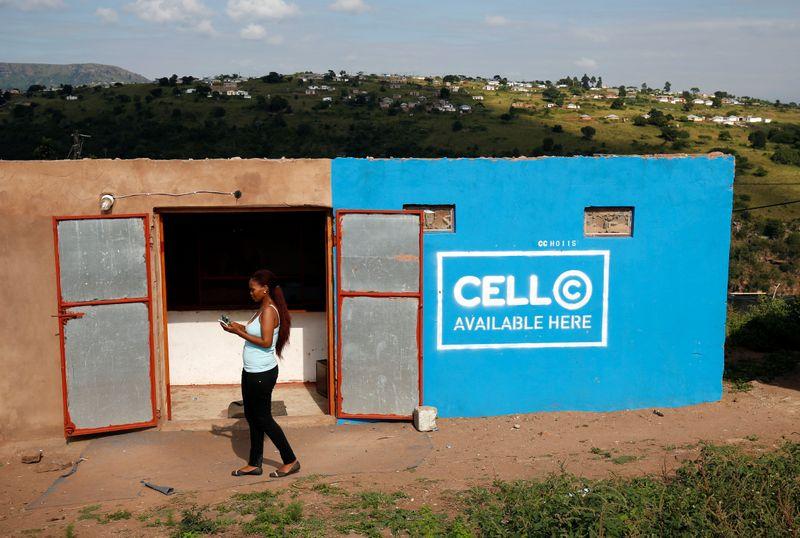

Cell C finalises long-awaited recap

The long-awaited recapitalisation of debt-laden mobile phone operator Cell C has been concluded, setting the stage for a reboot of the firm with less capital-intensive business model.

The restructuring of the company's R7.3 billion debt pile will see its biggest shareholder, Blue Label Telecoms, provide liquidity via a secured loan of R1.46 billion, while it is also picking up R1.2 billion in pre-paid airtime.

Blue Label, which has 45% of the operator but will see this stake climb to just under half, once described the process of getting the lenders to agree on the company's debt restructure as "complex". In 2019, the company wrote down the value of its stake in Cell C to nil as the mobile phone operator battled to stay afloat. Blue Label owns shares in Cell C through its subsidiary, The Prepaid Company (TPC).

Cell C says a portion of R1.3 billion of the debt funding will be used to pay out the secured lenders as per the accepted compromise offer of 20c for every R1 of debt, or an 80% haircut.

Secured lenders who elected to remain invested in Cell C will loan an amount equal to the 20c received from the compromise offer under a new loan arrangement.

"The recapitalisation was the final and critical pillar of Cell C's turnaround strategy, deleveraging the balance sheet, providing liquidity to operate, and putting the company on a trajectory of growth and long-term sustainability," said Cell C Chief Executive Douglas Craigie Stevenson.-Fin24

While it’s not back to its pre-pandemic position, the City Lodge Hotel Group has doubled its revenue over the past year.

The group's results for the financial year until the end of June 2022, released on Wednesday, show revenue more than doubled from R0.51 billion in the 2021 financial year to R1.10 billion in 2022 - still about a quarter below its pre-pandemic performance in 2019.

The group reported a profit after tax of R81.7 million compared to a net loss of R804.6 million in 2021. Its profit after tax is still 60% below 2019 levels.

It suffered a headline loss per share of 9c over the past year, an improvement on a loss per share of 91c in the previous financial year. As in 2021, the group has again not declared a dividend.

Average group occupancies increased from 19% last year to 38% in the past year. Occupancies for SA hotels averaged 40% compared to 21% in 2021. SA hotels recorded occupancies of 53% in July 2022, 52% in August 2022, and 56% up to 18 September 2022.

"While the Covid-19 pandemic still lingers, the burden on the hospitality, travel and tourism sector lightened significantly during the year under review," CEO Andrew Widegger said in a statement.

"Occupancy rates heading north of 50% excites me, especially if they can reach pre-Covid-19 occupancy levels on the lower cost base," says Muneer Ahmed, equity analyst at Denker Capital. He says it’s clear that the second half was much stronger than the first due to a lifting of lockdown restrictions.-Fin24

Blow to McDonald's in case

A federal judge has allowed a discrimination lawsuit to proceed that argues that McDonald's refuses to advertise on Black-owned media networks.

Media entrepreneur Byron Allen, who is Black, has accused McDonald's of instituting a "racially discriminatory contracting process" in a lawsuit first filed in May 2021.

As the owner of Entertainment Studios Networks and the Weather Group, which includes the Weather Channel, he sought $10 billion in damages alleging that McDonald's established "a two-tiered, race based system and shut plaintiff out of the general market (i.e. white-owned media) tier."

However, a federal judge dismissed the suit in December, saying that the allegations were not sufficiently supported.

Following a legal back-and-forth, the same judge on Friday denied a request by McDonald's to dismiss the case, thereby allowing it to proceed.

Allen alleged that were his company white-owned it "would have received tens of millions of dollars in advertising revenue from McDonald's on an annual basis."

He also alleged that McDonald's contracts with a separate advertising agency for "African-American media" with an aim of spending a budget that "is de minimis compared to the general market budget."

Allen argues his company had programming geared towards a variety of viewers, especially after its 2018 purchase of the Weather Channel, and that McDonald's has advertised on "similarly situated, white-owned networks."-Fin24

Tencent Music rises after Hong Kong debut

Tencent Music Entertainment Group traded higher in Hong Kong’s exchange on Wednesday after a listing that didn’t involve selling new shares or raising funds.

The stock closed at HK$18.22 on Wednesday, having started at HK$18. Two class A shares in Hong Kong are equivalent to one American depository receipt in New York. The ADRs closed at $4.58 (HK$35.95) on Tuesday.

The Shenzhen-based company chose to debut in the Asian financial hub by way of introduction, a quicker and easier route for firms already listed elsewhere.

The firm controlled by tech giant Tencent is part of a growing group of Chinese firms choosing the method to list closer to home as escalating Sino-US tensions fuel delisting risks stateside.

According to terms of the listing, holders of ADRs will have the option to cancel their ADRs and receive equivalent class A shares in Hong Kong.

Volatile equity markets, high inflation and surging interest rates capped valuations worldwide for companies seeking to go public this year through traditional initial public offerings. As a consequence, there’s been a slump in proceeds raised in venues including New York, London and Hong Kong.

Electric-vehicles producer Nio Inc. debuted in Hong Kong in March using the same process, and later began trading in Singapore via the method. US-listed platform for housing transactions and services KE Holdings Inc. and software-as-a-service firm OneConnect Financial Technology Co. took the same path earlier this year.-Fin24

Cell C finalises long-awaited recap

The long-awaited recapitalisation of debt-laden mobile phone operator Cell C has been concluded, setting the stage for a reboot of the firm with less capital-intensive business model.

The restructuring of the company's R7.3 billion debt pile will see its biggest shareholder, Blue Label Telecoms, provide liquidity via a secured loan of R1.46 billion, while it is also picking up R1.2 billion in pre-paid airtime.

Blue Label, which has 45% of the operator but will see this stake climb to just under half, once described the process of getting the lenders to agree on the company's debt restructure as "complex". In 2019, the company wrote down the value of its stake in Cell C to nil as the mobile phone operator battled to stay afloat. Blue Label owns shares in Cell C through its subsidiary, The Prepaid Company (TPC).

Cell C says a portion of R1.3 billion of the debt funding will be used to pay out the secured lenders as per the accepted compromise offer of 20c for every R1 of debt, or an 80% haircut.

Secured lenders who elected to remain invested in Cell C will loan an amount equal to the 20c received from the compromise offer under a new loan arrangement.

"The recapitalisation was the final and critical pillar of Cell C's turnaround strategy, deleveraging the balance sheet, providing liquidity to operate, and putting the company on a trajectory of growth and long-term sustainability," said Cell C Chief Executive Douglas Craigie Stevenson.-Fin24

Kommentaar

Republikein

Geen kommentaar is op hierdie artikel gelaat nie