Company news in brief

More uranium found at Koppies

Australian-based Elevate Uranium plans to drill a total of 273 holes at its Koppies Project in the Erongo Region this quarter, the company said in its quarterly report released this morning.

This follows after drilling results at Koppies in the last quarter of 2023 increased Elevate’s global uranium resources to 142 million pounds (Mlb) of uranium oxide.

The mineral resource estimate (MRE) of Koppies in the last quarter of 2023 represented a 136% increase in the Koppies’ resource and a 42% increase in the Elevate’s Namibian resources.

“What a fantastic time to be in the uranium industry!” Elevate says on its website.

“Demand for carbon free energy, from a reliable base load source, continues to grow. Carbon free nuclear energy is powered by uranium and Elevate Uranium owns significant uranium resources in Namibia and Australia and has active exploration activities in both countries. The company plans to be a uranium supplier to the nuclear energy industry,” Elevate says.

Elevate is listed on the Australian Stock Exchange (ASX) the Development Capital Board (DevX) of the Namibian Stock Exchange (NSX). It closed Friday at N$6.96 per share.

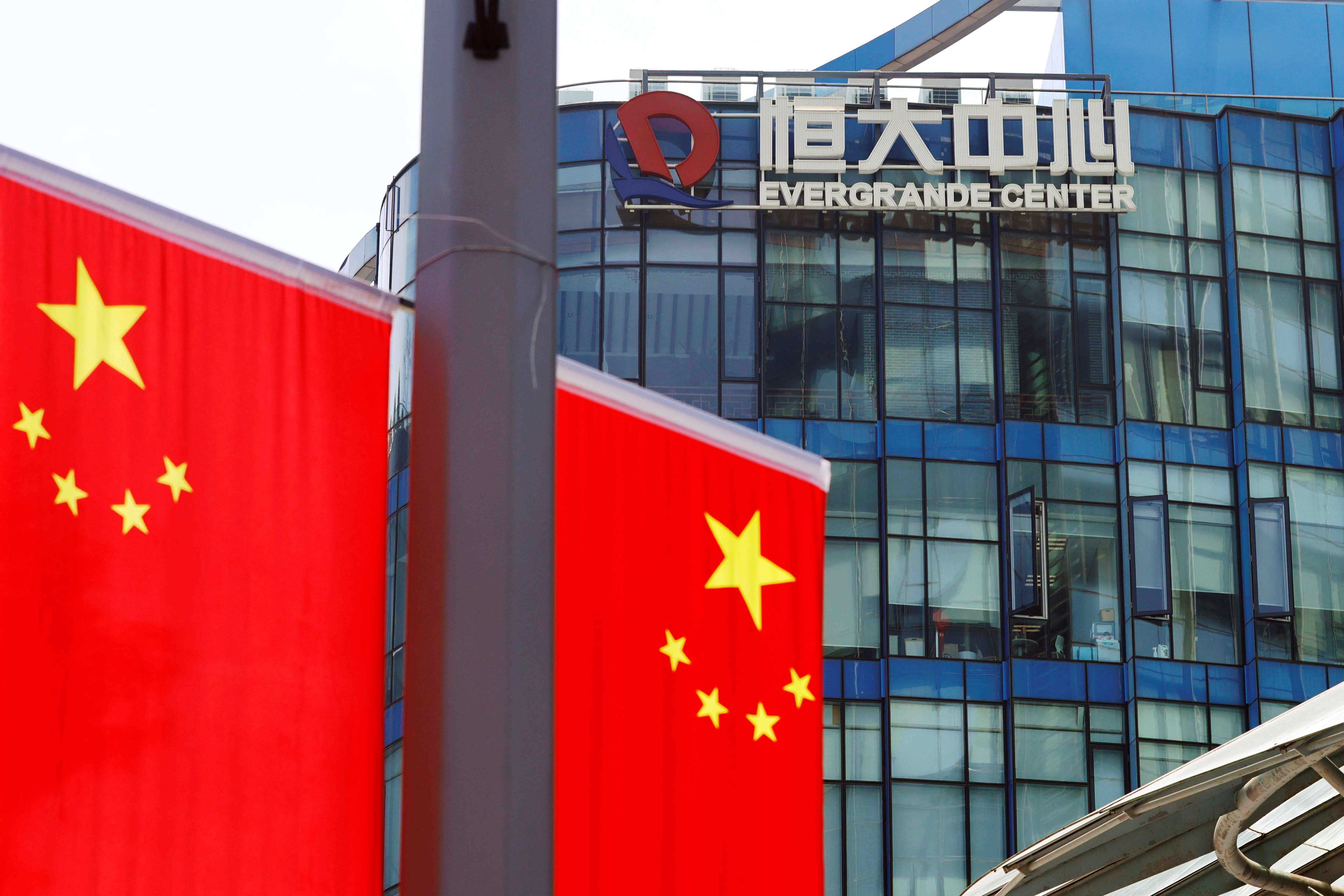

Evergrande ordered to liquidate

A Hong Kong court yesterday ordered the liquidation of property giant China Evergrande Group, a move likely to send ripples through China's crumbling financial markets as policymakers scramble to contain a deepening crisis.

Justice Linda Chan decided to liquidate the world's most indebted developer, with more than US$300 billion of total liabilities, after noting Evergrande had been unable to offer a concrete restructuring plan more than two years after defaulting on a bond repayment and after several court hearings.

"It is time for the court to say enough is enough," said Chan.

Evergrande chief executive Siu Shawn told Chinese media the company will ensure home building projects will still be delivered despite the liquidation order. The order would not affect the operations of Evergrande's onshore and offshore units, he added.

The decision sets the stage for what is expected to be drawn-out and complicated process with potential political considerations, given the many authorities involved.

Offshore investors will be focused on how Chinese authorities treat foreign creditors when a company fails. - Reuters

Transnet CEO on leave of absence

Transnet National Ports Authority CEO, Pepi Silinga, has taken a leave of absence amid investigations into suspicious activities at the division of the South African state-owned rail, port and pipeline operator Transnet.

A statement issued on Saturday by the group on behalf of acting Transnet chief executive, advocate Michelle Phillips, said an independent law firm had been briefed to investigate allegations of suspicious activities at TNPA, though little detail was provided on precisely what the activities entailed.

The statement added that Silinga had offered to take a leave of absence to allow the investigation to proceed without the perception of interference and to ensure that the integrity of the process is not compromised.

"Transnet has received a number of allegations regarding activities at TNPA. Transnet has a zero-tolerance stance on corruption, malfeasance and views these allegations in a serious light," the state-owned company said. "Transnet has accepted the offer made by Mr Silinga. The matter is being treated with urgency and more importantly, within the ambit of the law."

Transnet said Phyllis Difeto has been appointed acting chief executive of TNPA with immediate effect while the independent law firm it appointed peruses relevant documentation and interviews individuals relevant to its investigation.

Transnet suffered a hefty R1.6 billion loss in its half-year to end-September 2023 as rail volumes slumped on the back of the poor performance of its railway network, which has been plagued by cable theft, lack of equipment and loadshedding. – Fin24

Credit sales surge at Lewis

Embattled South Africans are increasingly turning to credit as they reel from the impact of higher fuel, food and borrowing costs, says South Africa’s largest furniture retailer, Lewis Group.

In the nine months to end-December 2023, the group's credit sales, which account for two-thirds of its total sales, rose by almost 18%, while its cash sales declined by more than 14%.

But even as customers opted for credit to cope with the impact of rising costs, Lewis said its collection rates were "resilient" at 80.7%, adding that this was similar to the levels reported in the six months to September 2023 – although lower than the 82% reported in the same period in the previous year.

It said debtor costs were 47.4% higher for the quarter and 59.8% higher for the nine-month period due to the "robust growth in the debtors book".

At a group level, Lewis reported that total revenue grew 8.7% in the nine-month period, saying it had grappled with an environment of "sustained pressure on consumer disposable income", while load shedding and port congestion continued to weigh negatively on economic growth. – Fin24

Australian-based Elevate Uranium plans to drill a total of 273 holes at its Koppies Project in the Erongo Region this quarter, the company said in its quarterly report released this morning.

This follows after drilling results at Koppies in the last quarter of 2023 increased Elevate’s global uranium resources to 142 million pounds (Mlb) of uranium oxide.

The mineral resource estimate (MRE) of Koppies in the last quarter of 2023 represented a 136% increase in the Koppies’ resource and a 42% increase in the Elevate’s Namibian resources.

“What a fantastic time to be in the uranium industry!” Elevate says on its website.

“Demand for carbon free energy, from a reliable base load source, continues to grow. Carbon free nuclear energy is powered by uranium and Elevate Uranium owns significant uranium resources in Namibia and Australia and has active exploration activities in both countries. The company plans to be a uranium supplier to the nuclear energy industry,” Elevate says.

Elevate is listed on the Australian Stock Exchange (ASX) the Development Capital Board (DevX) of the Namibian Stock Exchange (NSX). It closed Friday at N$6.96 per share.

Evergrande ordered to liquidate

A Hong Kong court yesterday ordered the liquidation of property giant China Evergrande Group, a move likely to send ripples through China's crumbling financial markets as policymakers scramble to contain a deepening crisis.

Justice Linda Chan decided to liquidate the world's most indebted developer, with more than US$300 billion of total liabilities, after noting Evergrande had been unable to offer a concrete restructuring plan more than two years after defaulting on a bond repayment and after several court hearings.

"It is time for the court to say enough is enough," said Chan.

Evergrande chief executive Siu Shawn told Chinese media the company will ensure home building projects will still be delivered despite the liquidation order. The order would not affect the operations of Evergrande's onshore and offshore units, he added.

The decision sets the stage for what is expected to be drawn-out and complicated process with potential political considerations, given the many authorities involved.

Offshore investors will be focused on how Chinese authorities treat foreign creditors when a company fails. - Reuters

Transnet CEO on leave of absence

Transnet National Ports Authority CEO, Pepi Silinga, has taken a leave of absence amid investigations into suspicious activities at the division of the South African state-owned rail, port and pipeline operator Transnet.

A statement issued on Saturday by the group on behalf of acting Transnet chief executive, advocate Michelle Phillips, said an independent law firm had been briefed to investigate allegations of suspicious activities at TNPA, though little detail was provided on precisely what the activities entailed.

The statement added that Silinga had offered to take a leave of absence to allow the investigation to proceed without the perception of interference and to ensure that the integrity of the process is not compromised.

"Transnet has received a number of allegations regarding activities at TNPA. Transnet has a zero-tolerance stance on corruption, malfeasance and views these allegations in a serious light," the state-owned company said. "Transnet has accepted the offer made by Mr Silinga. The matter is being treated with urgency and more importantly, within the ambit of the law."

Transnet said Phyllis Difeto has been appointed acting chief executive of TNPA with immediate effect while the independent law firm it appointed peruses relevant documentation and interviews individuals relevant to its investigation.

Transnet suffered a hefty R1.6 billion loss in its half-year to end-September 2023 as rail volumes slumped on the back of the poor performance of its railway network, which has been plagued by cable theft, lack of equipment and loadshedding. – Fin24

Credit sales surge at Lewis

Embattled South Africans are increasingly turning to credit as they reel from the impact of higher fuel, food and borrowing costs, says South Africa’s largest furniture retailer, Lewis Group.

In the nine months to end-December 2023, the group's credit sales, which account for two-thirds of its total sales, rose by almost 18%, while its cash sales declined by more than 14%.

But even as customers opted for credit to cope with the impact of rising costs, Lewis said its collection rates were "resilient" at 80.7%, adding that this was similar to the levels reported in the six months to September 2023 – although lower than the 82% reported in the same period in the previous year.

It said debtor costs were 47.4% higher for the quarter and 59.8% higher for the nine-month period due to the "robust growth in the debtors book".

At a group level, Lewis reported that total revenue grew 8.7% in the nine-month period, saying it had grappled with an environment of "sustained pressure on consumer disposable income", while load shedding and port congestion continued to weigh negatively on economic growth. – Fin24

Kommentaar

Republikein

Geen kommentaar is op hierdie artikel gelaat nie