Company news in brief

Regulator continues probing Steinhoff

South Africa's Independent Regulatory Board for Auditors (IRBA) said on Sunday that following its initial review of Steinhoff's auditors Deloitte South Africa it would pursue further lines of investigation.

The IRBA said in December 2017 it would investigate Steinhoff's auditor following the retail group's disclosure of accounting irregularities.

Steinhoff, whose more than 40 brands include Britain's Poundland, revealed accounting irregularities in December.

"The Steinhoff case is a multifaceted one which will require significant investigation. Nevertheless, our initial review of the audit files has identified some lines of further investigation which we are pursuing,” the IRBA said in a statement. It did not give further details. – Nampa/Reuters

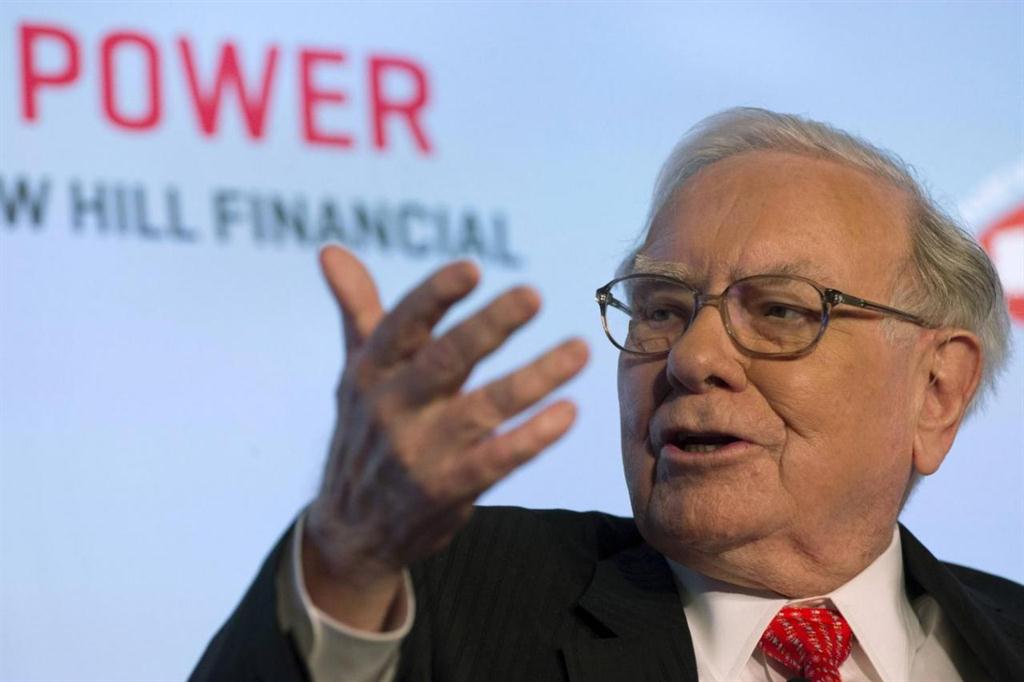

Buffett says Berkshire needs 'huge' deals

Warren Buffett on Saturday lamented his inability to find big companies to buy and said his goal is to make "one or more huge acquisitions" of non-insurance businesses to bolster results at his conglomerate Berkshire Hathaway Inc.

In his annual letter to Berkshire shareholders, Buffett said finding things to buy at a "sensible purchase price" has become a challenge and is a major reason Berkshire is awash with US$116 billion of low-yielding cash and government bonds.

Buffett said a "purchasing frenzy" binge by deal-hungry chief executives employing cheap debt has made that task difficult. Berkshire typically pays all cash for acquisitions.

Berkshire posted a record US$44.94 billion annual profit, though US$29.1 billion stemmed from the slashing of the US corporate tax rate, which reduced the Omaha, Nebraska-based conglomerate's deferred tax liabilities. Book value per share, measuring assets minus liabilities, rose 23% in 2017.

It has been more than two years since Buffett made a major purchase, the $32.1 billion takeover of aircraft parts maker Precision Castparts Corp, and his advancing age of 87 gives him less time to find more of the "elephants" he prefers. – Nampa/Reuters

Dropbox files for IPO of up to US$500 million

Data-sharing business Dropbox Inc on Friday filed for an initial public offering of up to $500 million with the US Securities and Exchange Commission.

The San Francisco-based company, which started as a free service to share and store photos, music and other large files, competes with much larger technology firms such as Alphabet Inc's Google, Microsoft Corp and Amazon.com Inc as well as cloud-storage rival Box Inc.

It plans to have its common stock listed on Nasdaq under the ticker symbol "DBX."

In its regulatory filing, Dropbox reported 2017 revenue of US$1.11 billion, up 31% from US$844.8 million a year earlier. The company's net loss narrowed to US$111.7 million in 2017 from US$210.2 million in 2016. – Nampa/Reuters

Gupta firms seek insolvency protection

At least eight companies owned by the wealthy Gupta family accused of corrupt ties to former president Jacob Zuma, have filed for protection from creditors, documents showed on Friday.

The Indian-born billionaire business associates of Zuma, were accused of using their political connections to win state contracts and influence cabinet appointments, in a report by an anti-graft watchdog in 2016. Zuma and the Gupta brothers deny any wrongdoing.

The Companies and Intellectual Property Commission (CIPC), South Africa’s companies registry office, shows on its website that eight firms owned by the Gupta's sought protection from creditors on Feb. 20, including Optimum Coal mine, which has faced a strike by its workers last week over unpaid salaries.

Another mining operation, Koornfontein Mine, is also listed, along with Optimum Coal Terminal and Tegeta Exploration and Resources in the coal sector.

The other firms are Shiva Uranium, VR Laser, Islandsite Investments One Hundred and Eighty, Confident Cocepts. – Nampa/Reuters

Deutsche Bank announces listing

Deutsche Bank yesterday said it plans to float its asset management arm DWS on the Frankfurt stock exchange, as it fights to regain investor trust after years of scandals and restructuring.

Germany's flagship lender did not specify a date for the listing, but sources close to the matter said last week that the initial public offering (IPO) would likely take place in the week of March 19.

The bank is expected to sell 25% of existing DWS shares for 1.5 billion to 2 billion euro (US$1.9 billion to US$2.5 billion), the sources said.

There were other IPO announcements in Europe yesterday, as well, including from Dutch bank NIBC and wholesaler B&S Group and French firm Vente-Unique. – Nampa/Reuters

South Africa's Independent Regulatory Board for Auditors (IRBA) said on Sunday that following its initial review of Steinhoff's auditors Deloitte South Africa it would pursue further lines of investigation.

The IRBA said in December 2017 it would investigate Steinhoff's auditor following the retail group's disclosure of accounting irregularities.

Steinhoff, whose more than 40 brands include Britain's Poundland, revealed accounting irregularities in December.

"The Steinhoff case is a multifaceted one which will require significant investigation. Nevertheless, our initial review of the audit files has identified some lines of further investigation which we are pursuing,” the IRBA said in a statement. It did not give further details. – Nampa/Reuters

Buffett says Berkshire needs 'huge' deals

Warren Buffett on Saturday lamented his inability to find big companies to buy and said his goal is to make "one or more huge acquisitions" of non-insurance businesses to bolster results at his conglomerate Berkshire Hathaway Inc.

In his annual letter to Berkshire shareholders, Buffett said finding things to buy at a "sensible purchase price" has become a challenge and is a major reason Berkshire is awash with US$116 billion of low-yielding cash and government bonds.

Buffett said a "purchasing frenzy" binge by deal-hungry chief executives employing cheap debt has made that task difficult. Berkshire typically pays all cash for acquisitions.

Berkshire posted a record US$44.94 billion annual profit, though US$29.1 billion stemmed from the slashing of the US corporate tax rate, which reduced the Omaha, Nebraska-based conglomerate's deferred tax liabilities. Book value per share, measuring assets minus liabilities, rose 23% in 2017.

It has been more than two years since Buffett made a major purchase, the $32.1 billion takeover of aircraft parts maker Precision Castparts Corp, and his advancing age of 87 gives him less time to find more of the "elephants" he prefers. – Nampa/Reuters

Dropbox files for IPO of up to US$500 million

Data-sharing business Dropbox Inc on Friday filed for an initial public offering of up to $500 million with the US Securities and Exchange Commission.

The San Francisco-based company, which started as a free service to share and store photos, music and other large files, competes with much larger technology firms such as Alphabet Inc's Google, Microsoft Corp and Amazon.com Inc as well as cloud-storage rival Box Inc.

It plans to have its common stock listed on Nasdaq under the ticker symbol "DBX."

In its regulatory filing, Dropbox reported 2017 revenue of US$1.11 billion, up 31% from US$844.8 million a year earlier. The company's net loss narrowed to US$111.7 million in 2017 from US$210.2 million in 2016. – Nampa/Reuters

Gupta firms seek insolvency protection

At least eight companies owned by the wealthy Gupta family accused of corrupt ties to former president Jacob Zuma, have filed for protection from creditors, documents showed on Friday.

The Indian-born billionaire business associates of Zuma, were accused of using their political connections to win state contracts and influence cabinet appointments, in a report by an anti-graft watchdog in 2016. Zuma and the Gupta brothers deny any wrongdoing.

The Companies and Intellectual Property Commission (CIPC), South Africa’s companies registry office, shows on its website that eight firms owned by the Gupta's sought protection from creditors on Feb. 20, including Optimum Coal mine, which has faced a strike by its workers last week over unpaid salaries.

Another mining operation, Koornfontein Mine, is also listed, along with Optimum Coal Terminal and Tegeta Exploration and Resources in the coal sector.

The other firms are Shiva Uranium, VR Laser, Islandsite Investments One Hundred and Eighty, Confident Cocepts. – Nampa/Reuters

Deutsche Bank announces listing

Deutsche Bank yesterday said it plans to float its asset management arm DWS on the Frankfurt stock exchange, as it fights to regain investor trust after years of scandals and restructuring.

Germany's flagship lender did not specify a date for the listing, but sources close to the matter said last week that the initial public offering (IPO) would likely take place in the week of March 19.

The bank is expected to sell 25% of existing DWS shares for 1.5 billion to 2 billion euro (US$1.9 billion to US$2.5 billion), the sources said.

There were other IPO announcements in Europe yesterday, as well, including from Dutch bank NIBC and wholesaler B&S Group and French firm Vente-Unique. – Nampa/Reuters

Kommentaar

Republikein

Geen kommentaar is op hierdie artikel gelaat nie