IMF points to emerging market risks

An abrupt increase in interest rates would raise the debt costs of a number of emerging countries.

Washington - The International Monetary Fund has welcomed the US Federal Reserve's decision to more quickly end its pandemic stimulus measures in the face of rising inflation, but warned poorer countries face risks.

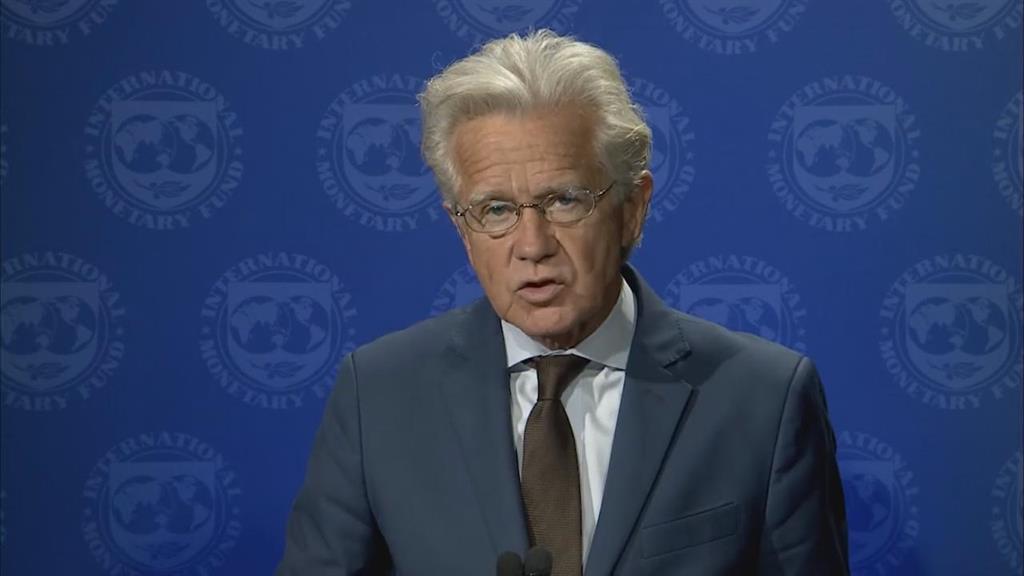

"The Federal Reserve has announced a well-calibrated, proportionate response to rising wage and price pressures by accelerating the reduction in its asset purchases and signalling a more front-loaded path for the federal funds rate," said the fund's spokesman Gerry Rice.

He recommended that the US central bank continue to set policy based on economic data while also signalling its intentions in advance.

The Fed on Wednesday decided to accelerate the pace of the rollback of its monthly bond-buying programme, which it said it must finish before it would consider raising interest rates from zero.

However Rice warned "this faster pace of Fed normalisation does increase the risks faced by countries relying on dollar funding, especially emerging and developing economies."

An abrupt increase in interest rates would raise the debt costs of a number of emerging countries, which are otherwise lagging behind in the global economic recovery from Covid-19.

ECB

The European Central Bank is "very unlikely" to raise interest rates in 2022, president Christine Lagarde reiterated Thursday, after other central banks moved to combat soaring inflation through rate hikes.

"It is very unlikely that we will raise interest rates in the year 2022," Lagarde said, confirming that the ECB plans to gradually wind down its stimulus bond-purchasing schemes first before moving on rates. Earlier, the Bank of England surprised markets with an unexpected rate hike. – Nampa/AFP

"The Federal Reserve has announced a well-calibrated, proportionate response to rising wage and price pressures by accelerating the reduction in its asset purchases and signalling a more front-loaded path for the federal funds rate," said the fund's spokesman Gerry Rice.

He recommended that the US central bank continue to set policy based on economic data while also signalling its intentions in advance.

The Fed on Wednesday decided to accelerate the pace of the rollback of its monthly bond-buying programme, which it said it must finish before it would consider raising interest rates from zero.

However Rice warned "this faster pace of Fed normalisation does increase the risks faced by countries relying on dollar funding, especially emerging and developing economies."

An abrupt increase in interest rates would raise the debt costs of a number of emerging countries, which are otherwise lagging behind in the global economic recovery from Covid-19.

ECB

The European Central Bank is "very unlikely" to raise interest rates in 2022, president Christine Lagarde reiterated Thursday, after other central banks moved to combat soaring inflation through rate hikes.

"It is very unlikely that we will raise interest rates in the year 2022," Lagarde said, confirming that the ECB plans to gradually wind down its stimulus bond-purchasing schemes first before moving on rates. Earlier, the Bank of England surprised markets with an unexpected rate hike. – Nampa/AFP

Kommentaar

Republikein

Geen kommentaar is op hierdie artikel gelaat nie