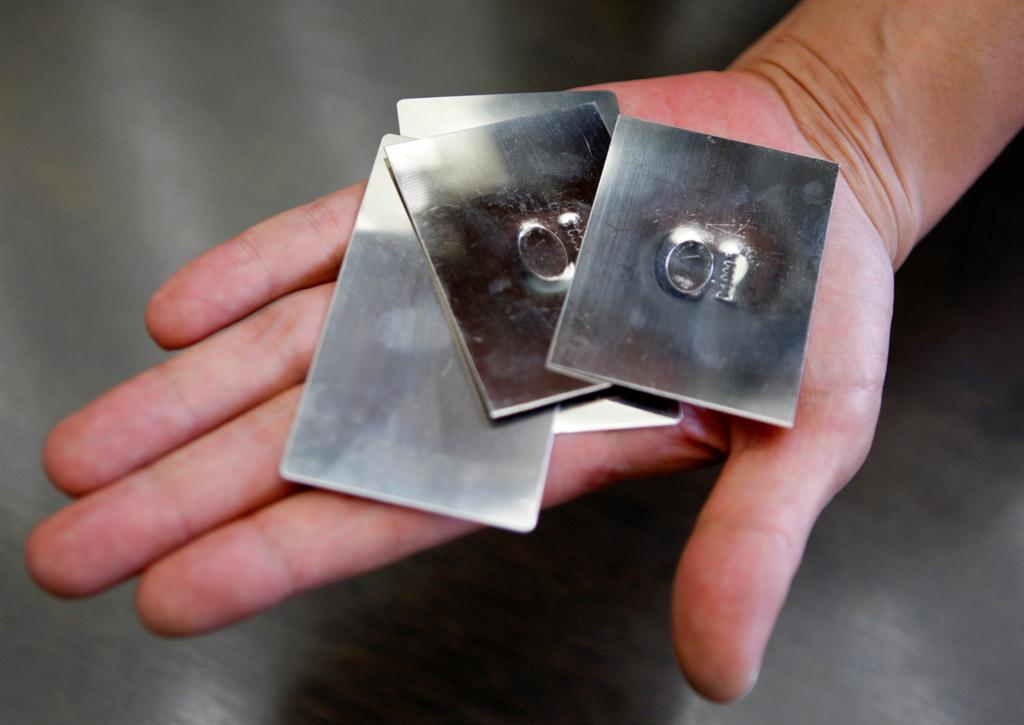

Palladium outshines gold for first time in 16 years

A sustained supply deficit coupled with robust demand and rising interest from speculators have pushed prices of palladium up.

Arpan Varghese and Swati Verma - Palladium is more valuable than gold for the first time since 2002, with prices soaring by around 50% in less than four months to record levels - just as gold failed to capitalise on some seemingly bullish scenarios.

A sustained supply deficit coupled with robust demand and rising interest from speculators have pushed prices of palladium - used mainly in emissions-reducing catalysts for vehicles - from around US$832 an ounce in mid-August to a high of US$1 263.56 per ounce on Wednesday.

Palladium was trading at a premium of more than US$25 an ounce to gold on Wednesday, in striking contrast to about two years ago when bullion was twice as expensive.

Gold is meanwhile stuck in the doldrums around US$1 235, having largely lost out to the dollar this year as a US-China trade row escalated against a backdrop of rising interest rates.

Expectations that investors might turn to gold as a safe haven asset at a time of rising economic uncertainty and protectionism have been dented.

"It [parity with gold] is fundamentally justified. The market has been in sustained deficit and the effects of that are being borne out," said Marcus Garvey, analyst at ICBC Standard bank.

Platinum

Palladium's gains this year have overshadowed platinum as well, having overtaken its better-known sister metal last year.

Both are primarily consumed by automakers for catalytic converter manufacturing, but platinum is more heavily used in the diesel vehicles that have fallen out of favour since the Volkswagen emissions-rigging scandal broke in 2015.

"Palladium is characterised by the strongest supply-demand backdrop across the major precious metals," precious metals consultancy Metals Focus said in a note.

Supplies from major producers including Russia and South Africa are also not growing, analysts said.

Metals Focus said it expected global automotive palladium demand to achieve a new record high in 2018 of around 8.5 million ounces.

Palladium, unlike platinum, has benefited from a switch to petrol engines and expectations for growth in hybrid electric vehicles, which tend to be gasoline-powered.

This has helped the metal largely ignore falling car sales across the globe, especially in China, the world's largest auto market, where sales marked a fourth straight month of declines.

Longer term, though, widespread adoption of electric vehicles (EVs) could lead to reduced demand for both platinum and palladium in autocatalysts.

"Palladium seems to have been successfully marketed as the 'go-to' input in hybrids before the EV market share hits an inflection point," analysts at Scotiabank wrote in a note.

Speculative interest

Commerzbank said the rise in palladium prices was accompanied by high speculative interest, reflected in the strong build-up of net long positions.

"In the short term, more speculators could jump on the bandwagon and drive the price even higher, especially as the palladium market is very small and illiquid," it said.

However, palladium's strong run could run out of steam, as technical analysis charts show prices now moving into overbought territory, which could enable gold to re-establish its premium over palladium, analysts said.

"It's clearly reached a level where a question will be asked whether this move is justified and that eventually will lead to some profit-taking," Saxo Bank analyst Ole Hansen said.

Gold meanwhile has suffered from the all-encompassing strength of the US dollar, with other traditional safe havens such as the Japanese yen also losing out.

Investors favouring the US dollar over gold has proved a double negative as a stronger greenback makes gold more expensive for buyers with other currencies, dampening demand. – Nampa/Reuters

A sustained supply deficit coupled with robust demand and rising interest from speculators have pushed prices of palladium - used mainly in emissions-reducing catalysts for vehicles - from around US$832 an ounce in mid-August to a high of US$1 263.56 per ounce on Wednesday.

Palladium was trading at a premium of more than US$25 an ounce to gold on Wednesday, in striking contrast to about two years ago when bullion was twice as expensive.

Gold is meanwhile stuck in the doldrums around US$1 235, having largely lost out to the dollar this year as a US-China trade row escalated against a backdrop of rising interest rates.

Expectations that investors might turn to gold as a safe haven asset at a time of rising economic uncertainty and protectionism have been dented.

"It [parity with gold] is fundamentally justified. The market has been in sustained deficit and the effects of that are being borne out," said Marcus Garvey, analyst at ICBC Standard bank.

Platinum

Palladium's gains this year have overshadowed platinum as well, having overtaken its better-known sister metal last year.

Both are primarily consumed by automakers for catalytic converter manufacturing, but platinum is more heavily used in the diesel vehicles that have fallen out of favour since the Volkswagen emissions-rigging scandal broke in 2015.

"Palladium is characterised by the strongest supply-demand backdrop across the major precious metals," precious metals consultancy Metals Focus said in a note.

Supplies from major producers including Russia and South Africa are also not growing, analysts said.

Metals Focus said it expected global automotive palladium demand to achieve a new record high in 2018 of around 8.5 million ounces.

Palladium, unlike platinum, has benefited from a switch to petrol engines and expectations for growth in hybrid electric vehicles, which tend to be gasoline-powered.

This has helped the metal largely ignore falling car sales across the globe, especially in China, the world's largest auto market, where sales marked a fourth straight month of declines.

Longer term, though, widespread adoption of electric vehicles (EVs) could lead to reduced demand for both platinum and palladium in autocatalysts.

"Palladium seems to have been successfully marketed as the 'go-to' input in hybrids before the EV market share hits an inflection point," analysts at Scotiabank wrote in a note.

Speculative interest

Commerzbank said the rise in palladium prices was accompanied by high speculative interest, reflected in the strong build-up of net long positions.

"In the short term, more speculators could jump on the bandwagon and drive the price even higher, especially as the palladium market is very small and illiquid," it said.

However, palladium's strong run could run out of steam, as technical analysis charts show prices now moving into overbought territory, which could enable gold to re-establish its premium over palladium, analysts said.

"It's clearly reached a level where a question will be asked whether this move is justified and that eventually will lead to some profit-taking," Saxo Bank analyst Ole Hansen said.

Gold meanwhile has suffered from the all-encompassing strength of the US dollar, with other traditional safe havens such as the Japanese yen also losing out.

Investors favouring the US dollar over gold has proved a double negative as a stronger greenback makes gold more expensive for buyers with other currencies, dampening demand. – Nampa/Reuters

Kommentaar

Republikein

Geen kommentaar is op hierdie artikel gelaat nie