Price monster throws consumer a bone

Food inflation movements in 2020 will largely depend on how much rain Namibia gets.

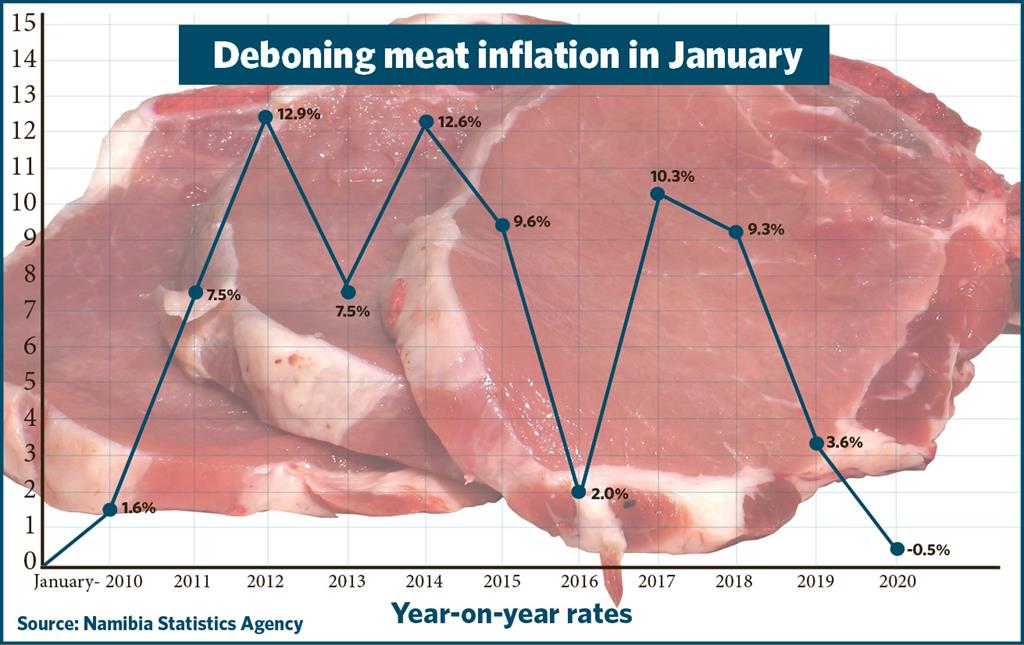

Consumers had to wait 15 years to kick off a new year with meat in deflation and last month didn't disappoint: Annual meat inflation in January came in at -0.5%.

The last time meat inflation in January found itself in negative territory was in 2005 when it was -2.3%.

New data released by the Namibia Statistics Agency (NSA) shows meat has mainly been in deflation on an annual basis since May last year. October was the exception with 1.9%. The lowest rate so far was recorded in December when meat deflation was -1.4%.

“The drought saw increased volumes of cattle slaughters leading to a sharp rise in the supply beef, resulting in some meat price deflation,” Cirrus Securities says in their latest economic outlook.

Should Namibia have a better rainy season, livestock farmers may reduce sales in order to restock their herds, thereby driving up meat prices, Cirrus continues.

Simonis Storm agrees: “We expect meat prices to surprise to the upside on the back of supply constrains as farmers embark on restocking,” the analysts say.

Overall food inflation

Annual overall food inflation, non-alcoholic beverages excluded, last month cooled off to 2.1% compared to 6.1% in January 2019.

Looking at Januaries in the past decade, food inflation reached boiling point at 13.5% in January 2017, while 0.9% in 2011 was its lowest point.

Food carries the second biggest weight in the Namibian consumer basket and only housing, water and power gobble up a bigger portion of households' disposable income. According to the NSA, the average consumer spends N$16.45 out of every N$100 in his pocket on food and non-alcoholic beverages.In their analysis of the latest inflation figures, IJG Securities points out that prices in twelve of the thirteen sub-categories of food recorded increases on an annual basis in January. “The largest increases were observed in the prices of fruits which increased by 13.8% year-on-year and vegetables which increased by 8.4% year-on-year.”

Outlook

Whether the price monster start growing nails again depends on the rain. “Rainfall figures have so far been mixed, with the northern and eastern regions receiving normal- to above-normal amounts of rain, and the central and southern regions receiving below-normal amounts of rain.

“Should these regions continue to experience poor rainfall for the rest of the rainy season, local food production will be affected which could lead to higher food price inflation,” IJG says. According to Cirrus: “Should the region receive better rains, the resultant improvement in crop harvests should reduce the prices of some basic foodstuffs (or at least lessen the rate of price increases).” Simonis Storm is of the opinion that “better rainfall in the beginning of 2020 should support low prices in agricultural products, especially fruit and vegetables as well as cereals”.

“These categories have increased in excess of 10% in 2019 and we expect their prices to moderate due to a high base coupled with better expected harvest,” SS says.

Jo-Maré Duddy –

The last time meat inflation in January found itself in negative territory was in 2005 when it was -2.3%.

New data released by the Namibia Statistics Agency (NSA) shows meat has mainly been in deflation on an annual basis since May last year. October was the exception with 1.9%. The lowest rate so far was recorded in December when meat deflation was -1.4%.

“The drought saw increased volumes of cattle slaughters leading to a sharp rise in the supply beef, resulting in some meat price deflation,” Cirrus Securities says in their latest economic outlook.

Should Namibia have a better rainy season, livestock farmers may reduce sales in order to restock their herds, thereby driving up meat prices, Cirrus continues.

Simonis Storm agrees: “We expect meat prices to surprise to the upside on the back of supply constrains as farmers embark on restocking,” the analysts say.

Overall food inflation

Annual overall food inflation, non-alcoholic beverages excluded, last month cooled off to 2.1% compared to 6.1% in January 2019.

Looking at Januaries in the past decade, food inflation reached boiling point at 13.5% in January 2017, while 0.9% in 2011 was its lowest point.

Food carries the second biggest weight in the Namibian consumer basket and only housing, water and power gobble up a bigger portion of households' disposable income. According to the NSA, the average consumer spends N$16.45 out of every N$100 in his pocket on food and non-alcoholic beverages.In their analysis of the latest inflation figures, IJG Securities points out that prices in twelve of the thirteen sub-categories of food recorded increases on an annual basis in January. “The largest increases were observed in the prices of fruits which increased by 13.8% year-on-year and vegetables which increased by 8.4% year-on-year.”

Outlook

Whether the price monster start growing nails again depends on the rain. “Rainfall figures have so far been mixed, with the northern and eastern regions receiving normal- to above-normal amounts of rain, and the central and southern regions receiving below-normal amounts of rain.

“Should these regions continue to experience poor rainfall for the rest of the rainy season, local food production will be affected which could lead to higher food price inflation,” IJG says. According to Cirrus: “Should the region receive better rains, the resultant improvement in crop harvests should reduce the prices of some basic foodstuffs (or at least lessen the rate of price increases).” Simonis Storm is of the opinion that “better rainfall in the beginning of 2020 should support low prices in agricultural products, especially fruit and vegetables as well as cereals”.

“These categories have increased in excess of 10% in 2019 and we expect their prices to moderate due to a high base coupled with better expected harvest,” SS says.

Jo-Maré Duddy –

Kommentaar

Republikein

Geen kommentaar is op hierdie artikel gelaat nie