Spike in Letshego Nam’s impairment charge

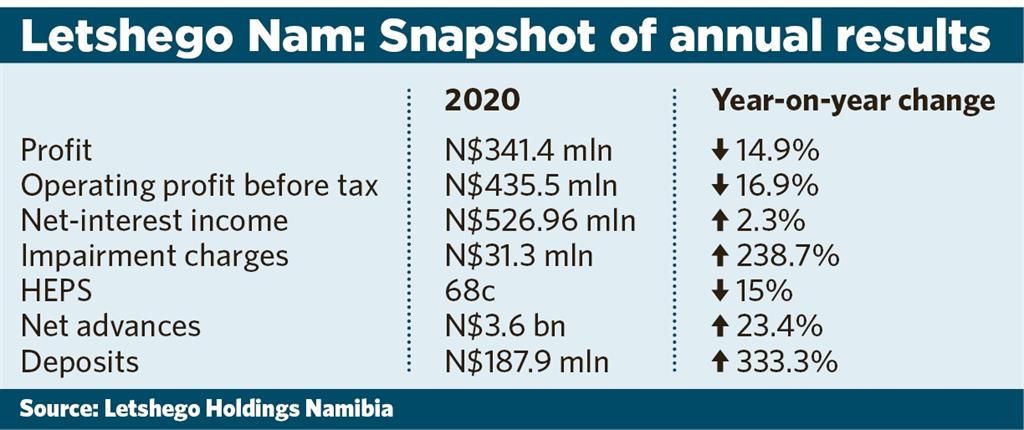

Jo-Maré Duddy – Letshego Holdings Namibia’s (LHN) impairment charge for the year ended 31 December 2020 spiked by about 239% on an annual basis, contributing to the locally-listed group reporting a drop of nearly N$60 million in profit compared to its previous book-year.

The group yesterday released its unaudited annual results on the Namibian Stock Exchange (NSX), which showed a profit of about N$341.4 million, down nearly 15% year-on-year.

Its impairment charge rose from about N$9.2 million in 2019 to nearly N$31.3 million in 2020. An impairment charge usually reflects a fall in value or worse-than-expected performance of the asset.

Also impacting profit was a restatement in the annual results of 2018 and 2019 to rectify a loan to preference share conversion transaction done in March 2018.

The reclassification of the loan from the parent company, Botswana-based Letshego Holdings Limited, as inter-company funding and not preference share funding resulted in interest expense increasing in the 2019 and 2018 financial years. This is, however, more tax efficient and beneficial to all shareholders, Cirrus Securities commented yesterday.

IMPAIRMENTS

Cirrus said due to LHN’s deduction-at-source business model, the group’s impairments have historically been kept to a minimum. The majority of the group’s clients are government employees, whose monthly debt to LHN is deducted from their salaries.

Cirrus believes the increase in impairments is due to LHN not charging insurance income since late in its 2019 financial year until April 2020.

“With the increase in impairments, the credit loss ratio increased to 94 basis points [bps] from 34 bps on 31 December 2019 and 35 bps on 30 June 2020,” the analysts said.

INCOME, ADVANCES

By not charging insurance income for a large part of its 2020 financial year, non-interest revenue decreased substantially, Cirrus said.

“In the 2019 financial year, non-interest revenue (fee and other operating income) made up 27.1% of total operating income at N$232.1 million. Over the last twelve months, this decreased to N$174.6 million resulted in non-interest revenue only contributing 22% to total operating income. This has, however, increased from the interim results,” they said.

LHN gained market share in its past financial year, Cirrus pointed out.

“LHN managed to increase gross advances to customers by 23.4% to N$3.6 billion. This is in line with management’s strategy and should be complimented,” they said.

However, Cirrus added: “Given that outstanding advances on 30 June 2020 totalled N$3.1 billion, the N$480 million worth of new advances will have been extended at much lower interest rates. The decreased interest income has, however, been countered by the increased advances and resulted in interest income remaining flat.”

Compared to its 2019 financial year, LHN’s deposits increased substantially – from around N$43.4 million to nearly N$187.9 million.

“We believe this is due to the lower interest rate environment and Letshego Bank offering more attractive interest rates. By implication LHN is paying up, which would hamper the net interest margin going forward,” Cirrus said.

‘MARKET CONFIDENCE’

“Although the local economic conditions and coronavirus (Covid-19) have affected market confidence and consumer spending patterns, the group remains well placed to grow revenues through ongoing innovation and pursuit of its inclusive finance strategy,” LHN said.

The directors have evaluated the financial impact of Covid-19 on the group and cannot identify a going concern risk within the medium term, it added.

LHN did not declare a dividend with the release of yesterday’s unaudited financials. It said a notice pertaining to dividends will be made at the time of the released of the audited financial statements for the year ended 31 December 2020, but made no mention of a date.

LHN is listed on the Local Index of the NSX. It ended Wednesday at N$2.20 per share. The share price has fallen by nearly 17.3% since the end of last year.

The group yesterday released its unaudited annual results on the Namibian Stock Exchange (NSX), which showed a profit of about N$341.4 million, down nearly 15% year-on-year.

Its impairment charge rose from about N$9.2 million in 2019 to nearly N$31.3 million in 2020. An impairment charge usually reflects a fall in value or worse-than-expected performance of the asset.

Also impacting profit was a restatement in the annual results of 2018 and 2019 to rectify a loan to preference share conversion transaction done in March 2018.

The reclassification of the loan from the parent company, Botswana-based Letshego Holdings Limited, as inter-company funding and not preference share funding resulted in interest expense increasing in the 2019 and 2018 financial years. This is, however, more tax efficient and beneficial to all shareholders, Cirrus Securities commented yesterday.

IMPAIRMENTS

Cirrus said due to LHN’s deduction-at-source business model, the group’s impairments have historically been kept to a minimum. The majority of the group’s clients are government employees, whose monthly debt to LHN is deducted from their salaries.

Cirrus believes the increase in impairments is due to LHN not charging insurance income since late in its 2019 financial year until April 2020.

“With the increase in impairments, the credit loss ratio increased to 94 basis points [bps] from 34 bps on 31 December 2019 and 35 bps on 30 June 2020,” the analysts said.

INCOME, ADVANCES

By not charging insurance income for a large part of its 2020 financial year, non-interest revenue decreased substantially, Cirrus said.

“In the 2019 financial year, non-interest revenue (fee and other operating income) made up 27.1% of total operating income at N$232.1 million. Over the last twelve months, this decreased to N$174.6 million resulted in non-interest revenue only contributing 22% to total operating income. This has, however, increased from the interim results,” they said.

LHN gained market share in its past financial year, Cirrus pointed out.

“LHN managed to increase gross advances to customers by 23.4% to N$3.6 billion. This is in line with management’s strategy and should be complimented,” they said.

However, Cirrus added: “Given that outstanding advances on 30 June 2020 totalled N$3.1 billion, the N$480 million worth of new advances will have been extended at much lower interest rates. The decreased interest income has, however, been countered by the increased advances and resulted in interest income remaining flat.”

Compared to its 2019 financial year, LHN’s deposits increased substantially – from around N$43.4 million to nearly N$187.9 million.

“We believe this is due to the lower interest rate environment and Letshego Bank offering more attractive interest rates. By implication LHN is paying up, which would hamper the net interest margin going forward,” Cirrus said.

‘MARKET CONFIDENCE’

“Although the local economic conditions and coronavirus (Covid-19) have affected market confidence and consumer spending patterns, the group remains well placed to grow revenues through ongoing innovation and pursuit of its inclusive finance strategy,” LHN said.

The directors have evaluated the financial impact of Covid-19 on the group and cannot identify a going concern risk within the medium term, it added.

LHN did not declare a dividend with the release of yesterday’s unaudited financials. It said a notice pertaining to dividends will be made at the time of the released of the audited financial statements for the year ended 31 December 2020, but made no mention of a date.

LHN is listed on the Local Index of the NSX. It ended Wednesday at N$2.20 per share. The share price has fallen by nearly 17.3% since the end of last year.

Kommentaar

Republikein

Geen kommentaar is op hierdie artikel gelaat nie