Economic outlook incredibly positive

All the right signs

Namibia is placed in an incredible position, according to Cirrus Capital chief economist Robert McGregor. He examines the country's economic prospects in the light of policy and the political landscape.

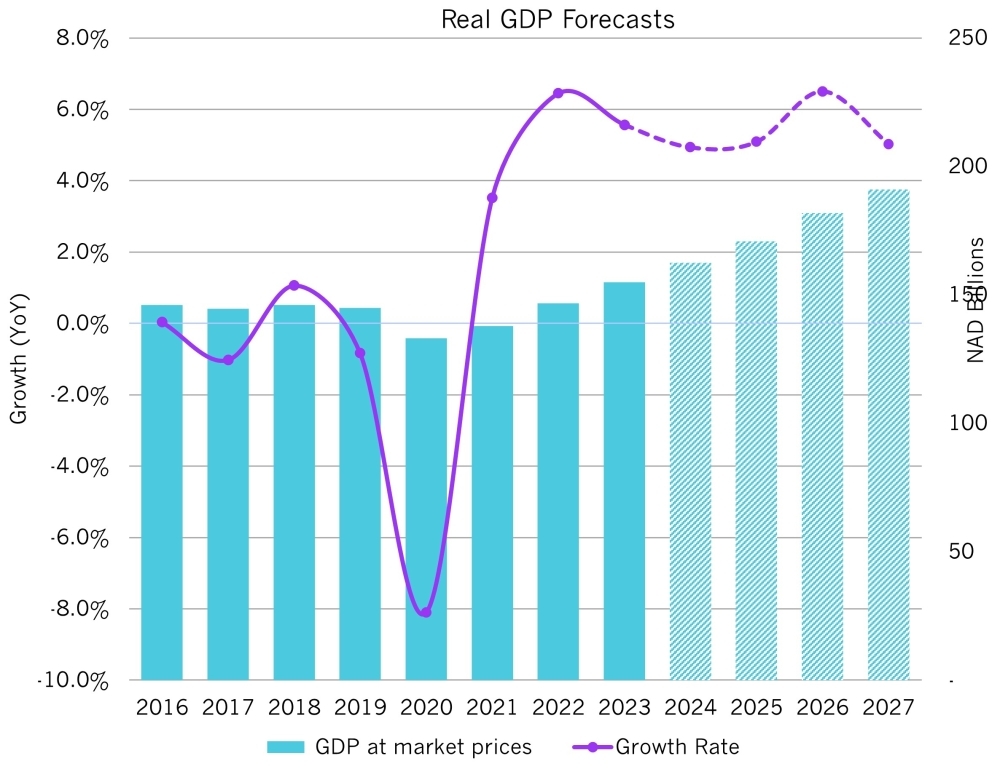

After several difficult years, the outlook for the Namibian economy is incredibly positive.

Economic growth hit encouraging levels in 2022 and 2023, although a large portion of this was driven by the extractives sector – including mineral output, as well as offshore oil and gas exploration.

While growth has been slower in the rest of the economy, there are ever more pockets of growth, with all the right signs that Namibia is still in the early stages of economic recovery.

Although the outlook is positive, there are still areas of concern.

Agriculture

The agriculture sector remains at risk.

The rains this season have been irregular and insufficient, seeing a material reduction in plantings and farmers opting for crops other than maize, whether dryland or irrigated farmland.

After a record harvest two years ago, we expect material contractions for crop farming this year.

Furthermore, livestock farmers face mounting pressures from poor rainfall and massive challenges in the meat processing sector, with ongoing troubles at Meatco.

However, current indications are for better rainfall in the next rain season, with recent data suggesting a shift to La Niña from the second half of this year.

Construction

The construction sector is also still a concern, with muted activity across the country and limited sizable projects underway or in the near-term horizon.

Nonetheless, we believe that the outlook for this sector is improving over the medium term. Increased economic activity, gradual improvements in wage adjustments and employment, as well as a variety of infrastructure projects lined up for the remainder of the decade should see growth returning here.

We expect a range of public enterprises to focus on infrastructure spending in the coming years, including Namport, NamPower and NamWater, while there are potentially at least three new mines lined up for construction in the coming years.

Mining

Pockets of growth have become increasingly encouraging.

While diamond prices are under pressure, which presents a risk to output and therefore growth, much of the slack here should be picked up my positive developments in gold, copper and uranium mining.

The latter is benefitting from materially higher prices as the world once again embraces nuclear energy, but fears a uranium supply deficit.

However, Namibia’s ability to capitalise on this resurgence is threatened by limited water supply at the coast and government’s refusal to allow more private sector desalination.

Electricity

The electricity sub-sector is benefitting from continued flow through Ruacana, while output is set to improve with NamPower’s infrastructure plans and ongoing private investment under the Modified Single Buyer Model framework.

Tourism

Tourism is seeing incredible growth despite limited flights to Namibia.

Several major airlines have stated their intentions to open a Windhoek route in the coming years, which would be a massive boost for a vital sector and propel it to new heights.

Logistics

The logistics sector has made incredible achievements the past three years, benefitting from increased economic activity in neighbouring countries while taking advantage of port inefficiencies across the region.

Namibia’s ports will continue to benefit from its efficiencies relative to the region, while also standing to benefit from increased oil and gas activity, as well as the potential for mining activity (including potential new uranium and gold mines).

Rail is still a massive challenge, and sits as one of the lowest-hanging fruit in this country. While government is making efforts to improve the railways, it may be this is too little, too late.

Spending power

Sectors directly facing households should see some improvement in trading conditions this year, as the impact of rapid rate hikes and high inflation subside.

This will be aided by the civil service wage adjustment, as well as a marginal improvement in private sector employment and wage prospects.

The improving fiscal outlook is also seeing government spend a bit more, directly contributing to growth where it had been a drag in prior years under much-needed fiscal consolidation.

Overall, sentiment across most (if not all) economic sectors has improved and is encouragingly positive, a material shift from where we were just 18 months ago.

However, we believe that risks to inflation remain weighted to the upside.

Chief amongst these are rand weakness, considering weak economic growth and upcoming elections in South Africa, and the risk of rising global commodity prices, particularly fuel, given increased geopolitical tensions and escalating conflicts.

This, we believe, will also result in regional interest rates likely remaining higher for longer, given the inflation-targeting mandate of the South African Reserve Bank (SARB).

Water

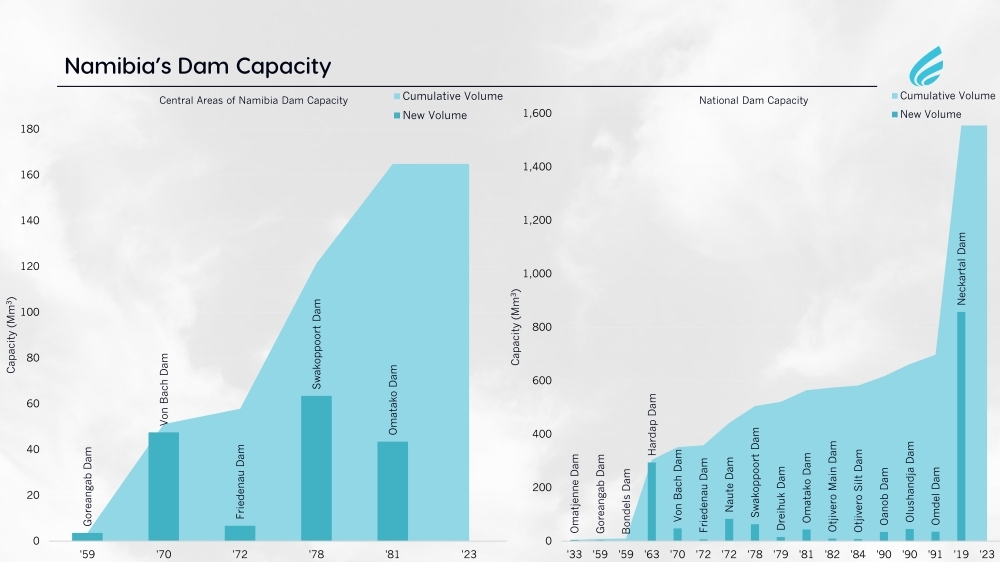

Water is also another of the challenges, with the central areas of Namibia facing worryingly low dam levels.

These water issues resurface every few years, but little concrete progress has been made to address this, and thus these challenges will likely keep resurfacing over the coming decade.

Policy

Namibia is placed in an incredible position.

Her current natural resource exposure appears opportune, given the rally in global uranium prices and growing adoption of nuclear energy.

Existing mines are ramping up production to take advantage of prices that are at their highest in over a decade, while Langer Heinrich has just restarted, and several prospective mines are chomping at the bit to begin construction.

However, this again requires that we remain sensible and pragmatic on policy.

This relates not only to taxation and local participation, but also on matters such as water provision (for instance, allowing private entities to construct desalination plants for their own needs and providing the excess to local authorities).

Oil

The hydrocarbon prospects are beyond incredible.

Quite simply, the potential scale of these developments dwarf anything Namibia has ever seen, and the country is – quite frankly – likely not ready for what precisely this may mean.

The oil majors have kept their cards pretty close to their chests, but market gossip and other indications are quite positive.

Nonetheless, we await official communications around the commercial viability of the already discovered resources, along with decisions on whether these will be developed.

This will again likely be driven down to domestic policy.

While the fiscal regime appears very favourable, certainty over decades is required. Given the policy missteps of recent years and policy announcements seemingly on a whim, investors at such a scale would understandably be hesitant.

Elections

Adding to some level of uncertainty are the elections slated for late this year.

With no polling in country, most analysts are flying blind.

At the moment, the likely outcome is for the (new) Swapo presidential candidate to fare somewhat better than in 2019, but overall support for Swapo in the National Assembly elections remains uncertain.

This will come down to voter turnout, as the youth are the overwhelming majority of the voting age population.

Should they turn up in good numbers, it will sway the elections, provided they feel they have credible choices. However, voter apathy is a material and would favour the ruling party.

Politics

Overall, Namibia appears to be moving in a generally positive direction.

While there are policy issues, and some mixed messages, there have been steps in the right direction.

Some appointments within the public sphere have also been encouraging, seeing technocrats and trustworthy administrators favoured over political appointments. As such, Namibia is setting herself ever more apart from the region.

Political interference, cadre deployment and unsustainable inward-looking (read: nationalist) policies are growing in favour in the region. Namibia risks falling into this trap.

However, at this stage, the divergence from some countries is an excellent opportunity to capitalise on improving sentiment domestically, increased international interest, and to attract both capital and skills that would otherwise leave the region.

Economic growth hit encouraging levels in 2022 and 2023, although a large portion of this was driven by the extractives sector – including mineral output, as well as offshore oil and gas exploration.

While growth has been slower in the rest of the economy, there are ever more pockets of growth, with all the right signs that Namibia is still in the early stages of economic recovery.

Although the outlook is positive, there are still areas of concern.

Agriculture

The agriculture sector remains at risk.

The rains this season have been irregular and insufficient, seeing a material reduction in plantings and farmers opting for crops other than maize, whether dryland or irrigated farmland.

After a record harvest two years ago, we expect material contractions for crop farming this year.

Furthermore, livestock farmers face mounting pressures from poor rainfall and massive challenges in the meat processing sector, with ongoing troubles at Meatco.

However, current indications are for better rainfall in the next rain season, with recent data suggesting a shift to La Niña from the second half of this year.

Construction

The construction sector is also still a concern, with muted activity across the country and limited sizable projects underway or in the near-term horizon.

Nonetheless, we believe that the outlook for this sector is improving over the medium term. Increased economic activity, gradual improvements in wage adjustments and employment, as well as a variety of infrastructure projects lined up for the remainder of the decade should see growth returning here.

We expect a range of public enterprises to focus on infrastructure spending in the coming years, including Namport, NamPower and NamWater, while there are potentially at least three new mines lined up for construction in the coming years.

Mining

Pockets of growth have become increasingly encouraging.

While diamond prices are under pressure, which presents a risk to output and therefore growth, much of the slack here should be picked up my positive developments in gold, copper and uranium mining.

The latter is benefitting from materially higher prices as the world once again embraces nuclear energy, but fears a uranium supply deficit.

However, Namibia’s ability to capitalise on this resurgence is threatened by limited water supply at the coast and government’s refusal to allow more private sector desalination.

Electricity

The electricity sub-sector is benefitting from continued flow through Ruacana, while output is set to improve with NamPower’s infrastructure plans and ongoing private investment under the Modified Single Buyer Model framework.

Tourism

Tourism is seeing incredible growth despite limited flights to Namibia.

Several major airlines have stated their intentions to open a Windhoek route in the coming years, which would be a massive boost for a vital sector and propel it to new heights.

Logistics

The logistics sector has made incredible achievements the past three years, benefitting from increased economic activity in neighbouring countries while taking advantage of port inefficiencies across the region.

Namibia’s ports will continue to benefit from its efficiencies relative to the region, while also standing to benefit from increased oil and gas activity, as well as the potential for mining activity (including potential new uranium and gold mines).

Rail is still a massive challenge, and sits as one of the lowest-hanging fruit in this country. While government is making efforts to improve the railways, it may be this is too little, too late.

Spending power

Sectors directly facing households should see some improvement in trading conditions this year, as the impact of rapid rate hikes and high inflation subside.

This will be aided by the civil service wage adjustment, as well as a marginal improvement in private sector employment and wage prospects.

The improving fiscal outlook is also seeing government spend a bit more, directly contributing to growth where it had been a drag in prior years under much-needed fiscal consolidation.

Overall, sentiment across most (if not all) economic sectors has improved and is encouragingly positive, a material shift from where we were just 18 months ago.

However, we believe that risks to inflation remain weighted to the upside.

Chief amongst these are rand weakness, considering weak economic growth and upcoming elections in South Africa, and the risk of rising global commodity prices, particularly fuel, given increased geopolitical tensions and escalating conflicts.

This, we believe, will also result in regional interest rates likely remaining higher for longer, given the inflation-targeting mandate of the South African Reserve Bank (SARB).

Water

Water is also another of the challenges, with the central areas of Namibia facing worryingly low dam levels.

These water issues resurface every few years, but little concrete progress has been made to address this, and thus these challenges will likely keep resurfacing over the coming decade.

Policy

Namibia is placed in an incredible position.

Her current natural resource exposure appears opportune, given the rally in global uranium prices and growing adoption of nuclear energy.

Existing mines are ramping up production to take advantage of prices that are at their highest in over a decade, while Langer Heinrich has just restarted, and several prospective mines are chomping at the bit to begin construction.

However, this again requires that we remain sensible and pragmatic on policy.

This relates not only to taxation and local participation, but also on matters such as water provision (for instance, allowing private entities to construct desalination plants for their own needs and providing the excess to local authorities).

Oil

The hydrocarbon prospects are beyond incredible.

Quite simply, the potential scale of these developments dwarf anything Namibia has ever seen, and the country is – quite frankly – likely not ready for what precisely this may mean.

The oil majors have kept their cards pretty close to their chests, but market gossip and other indications are quite positive.

Nonetheless, we await official communications around the commercial viability of the already discovered resources, along with decisions on whether these will be developed.

This will again likely be driven down to domestic policy.

While the fiscal regime appears very favourable, certainty over decades is required. Given the policy missteps of recent years and policy announcements seemingly on a whim, investors at such a scale would understandably be hesitant.

Elections

Adding to some level of uncertainty are the elections slated for late this year.

With no polling in country, most analysts are flying blind.

At the moment, the likely outcome is for the (new) Swapo presidential candidate to fare somewhat better than in 2019, but overall support for Swapo in the National Assembly elections remains uncertain.

This will come down to voter turnout, as the youth are the overwhelming majority of the voting age population.

Should they turn up in good numbers, it will sway the elections, provided they feel they have credible choices. However, voter apathy is a material and would favour the ruling party.

Politics

Overall, Namibia appears to be moving in a generally positive direction.

While there are policy issues, and some mixed messages, there have been steps in the right direction.

Some appointments within the public sphere have also been encouraging, seeing technocrats and trustworthy administrators favoured over political appointments. As such, Namibia is setting herself ever more apart from the region.

Political interference, cadre deployment and unsustainable inward-looking (read: nationalist) policies are growing in favour in the region. Namibia risks falling into this trap.

However, at this stage, the divergence from some countries is an excellent opportunity to capitalise on improving sentiment domestically, increased international interest, and to attract both capital and skills that would otherwise leave the region.

Kommentaar

Republikein

Geen kommentaar is op hierdie artikel gelaat nie